The Best Ideas I Found in Q1 2025 Investor Letters

From the letters of Greenlight Capital (David Einhorn), Alluvial Fund (Dave Waters), Arquitos Capital (Steven Kiel), David Poppe (Giverny Capital), and Michael Melby (Gate City Capital)

TL;DR

Companies/Assets mentioned in the letters:

Brighthouse Financial (BHF)

Core Natural Resources (CNR)

Green Brick Partners (GRBK)

Lanxess (ETR:LXS)

Solvay (EBR:SOLB)

Just Eat Takeaway (TKWY)

Syensqo (SYENS)

Gold

SOFR futures

Zegona Communications (LON: ZEG)

McBride (LON: MCB)

Titan America (TTAM) (FKA Titan Cement)

The Monarch Cement Company (OTCMKTS: MCEM)

Net Lease Office Properties (NLOP)

Peakstone Realty (PKST)

CBL Properties (CBL)

ENDI Corp (ENDI)

Finch Therapeutics (FNCH)

Nam Tai Property (NTPIF)

Liquidia Therapeutics (LQDA)

Lumine Group (CVE: LMN)

Five Below (FIVE)

Carmax (KMX)

Progressive (PGR)

TWFG (TWFG)

Builders FirstSource (BLDR)

Arista Networks (ANET)

Medpace Holdings (MEDP)

Kinsale Capital Group (KNSL)

Intrepid Potash (IPI)

Alico (ALCO)

Saga Communications (SGA)

Dorel Industries (DII.B)

Helix Energy Solutions (HLX)

Mosaic Co

Q1 2025 David Einhorn (Greenlight Capital) Letter Summary

We will avoid calling this market a bubble, and simply observe that the dividend yield is low and the P/E ratio is elevated despite corporate earnings being cyclically high, if not top-of cycle…

However, while we are conservatively positioned with respect to net exposure, we aren’t outright bearish. We are likely to continue to underperform a rising market, as we have all year, but we don’t wish to position ourselves to lose money should the market continue to rise.

In the letter, you can notice that Einhorn it's quite a bear.

We suspect we are now in a bear market that is just starting. The fact that the market has declined from its record highs does not make it inexpensive or attractive.

A few weeks ago, we thought this letter might include our observations on the massive amount of investment being poured into data centers and chips to support AI. Five of the Magnificent 7 have pledged essentially all their current cash flow to the pursuit of the AI opportunity, where returns on that investment are uncertain, and competition is sure to be fierce. We wondered whether, at some point, Wall Street might stop rewarding and, in fact, punish these companies for continually raising their promises of how much they would spend on products from NVIDIA and ancillary companies. Now, that seems trite.

Bear markets do not go straight down. They are punctuated with ‘rip-your-face-off’ rallies based on big headlines, extreme investor sentiment, and experience that buying the dip usually pays off. As a result, our strategy is not to try to make a lot of money by being net short. Instead, we have lowered our gross and net exposure. This should enable us to ride out the downswings and counter-trend upswings without too much damage. The goal is to preserve capital in our equity portfolio and emerge with substantial buying power when the opportunity set improves.

Then most of the letter is about Trump’s administration: Einhorn portrays Trump’s second term as highly disruptive, marked by rapid and chaotic changes across domestic policy, foreign relations, and trade. He describes the Administration’s approach as “go-fast and break-things,” warning that it risks destabilizing the global economy and alienating U.S. allies.

Domestically, there’s what he calls a libertarian push to dismantle government bureaucracy — though it’s debatable where he sees libertarianism in this — leading to a shrinking federal workforce. Meanwhile, protectionist trade policies are inflicting immediate economic harm without clear long-term benefits.

He also cautions that aggressive moves could erode trust in the U.S. Dollar’s reserve currency status. Notably, the Administration seems unconcerned about stock market declines, a major shift from past norms, which Einhorn believes adds to overall systemic risk for investors.

Comments on Holdings

Brighthouse Financial (BHF) was Greenlight’s best-performing long position, rising 20.7% during the quarter. Media reports indicated the company hired Goldman Sachs and Wells Fargo to explore a sale. David believes there’s strong interest from large asset managers and expects a sale at a healthy premium, although he notes market turbulence could still derail a potential deal.

Core Natural Resources (CNR) was the biggest detractor, falling 27.6%. The company, formed from the merger of CONSOL Energy and Arch Resources, was hurt by falling coal prices and a fire at one of its mines. Trade tensions could further impact its exports. Despite these issues, Greenlight views CNR's conservative balance sheet and its potential for significant stock buybacks as positives, especially with expected support for the coal industry from the Trump Administration.

Other major disclosed long positions at quarter-end included Green Brick Partners, Lanxess, and Solvay.

Greenlight exited its position in Just Eat Takeaway (TKWY) after it agreed to be acquired by Prosus. The sale produced a 52% gain and a 227% net IRR over five months.

They also sold Syensqo (SYENS), taking a 13% net loss. The initial hope for a re-rating did not materialize, and Einhorn decided to reallocate the capital to a better opportunity within the same sector.

In the macro portfolio, gold was the standout winner, appreciating 19% during the quarter. Greenlight holds gold both through bars and call options.

Additionally, they built positions in SOFR futures expecting greater Fed rate cuts, long-duration inflation swaps anticipating higher future inflation, and added tail hedges against potential USD depreciation vs. the Euro and Yen.

If you wanna learn more abou David Einhorn investment philosophy, check my following post

Q1 2025 Alluvial Fund Letter Summary

If you like microcaps, you should follow Alluvial Capital.

(BTW, I just launched a microcap ebook to learn how to invest in these kind of situations. So, if you feel lucky, grab your copy HERE).

of Alluvial Capital released his quarterly letter.After 11 years, Alluvial reached US$100 million in AUM (Kudos, Dave!)

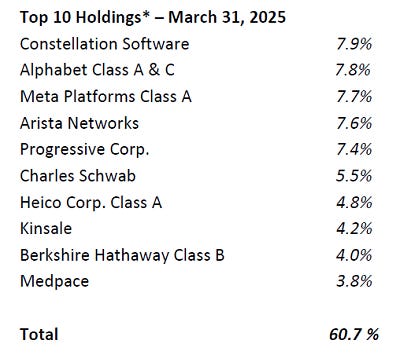

Current top holdings

Trump’s tariffs

Dave writes just 2 paragraphs about Trump's tariffs, saying that “the fund's direct exposure to these tariffs is low":

In a time of rising US-driven economic isolationism, the sophisticated global supply chains built by large companies are becoming something of a liability. Little of what our companies buy and sell ever crosses a US border. Some companies have no US presence and use little or no US products in their supply chain, like Bahnhof AB and We Connect SA. Our real estate companies are immune, obviously, at least until the executive figures out how to tariff an immovable object. Some of our companies, like Garrett Motion and FitLife Brands, will experience challenges if tariffs on the European Union and China are not reduced and resolved. But each company has the resources to adjust its supply chain and selling strategies to mitigate the effects. Poor Garrett Motion has faced a nearly unending series of economic adversities since exiting bankruptcy in 2021 but has still managed to reduce its share count by one-third since. Tariffs are just another bump in the road.

Comments on holdings

Zegona Communications (LON: ZEG) benefited from its acquisition of Vodafone Spain, progressing with cost cuts and the planned sale of valuable fiber assets, which should deleverage the company and allow for shareholder returns.

McBride (LON: MCB), a maker of household products, delivered strong financial results but remains undervalued due to continued selling pressure from a large institutional shareholder. A dividend reinstatement later this year could boost its share price by attracting more retail investors.

Titan Cement successfully listed its American operations separately on the NYSE under the name "Titan America SA." Following this move, Titan plans to return most of the proceeds from the listing to shareholders as a special dividend, an action that would meaningfully enhance shareholder value. Despite a rise in its valuation, Titan Cement still trades at a substantial discount to fair value. Although Titan is not expected to sell significantly more cement this year compared to last, pricing actions and an overall strong position in the market should continue to support revenue growth.

The Monarch Cement Company (OTCMKTS: MCEM) successfully implemented an 8% price increase in January 2025, which should positively impact its revenues this year even if sales volumes remain flat. Like Titan, Monarch benefits from an environment where cement pricing power remains strong due to long-term underinvestment in cement production capacity following the Financial Crisis. Waters acknowledges that a weakening economy would pose some risks to cement demand because of its close link to construction activity, but he remains confident that supply constraints and strong pricing will protect profitability for both Titan and Monarch over the coming years.

Dave also mentions why he invests in Real Estate (RE):

Alluvial Fund has done well in buying deeply discounted real estate in struggling sectors of the real estate market. Buying fundamentally sound property portfolios and waiting for sentiment to improve fits our long-term approach and willingness to own unpopular assets. We bought Scandinavian hotels coming out of the COVID downturn, and US office properties just when “work from home” was at its peak. Each worked quite well.

Net Lease Office Properties (NLOP), which performed well during the quarter. The company is liquidating assets, including the "Binoculars Building" in Los Angeles leased to Google, and will soon return cash to shareholders.

Peakstone Realty (PKST) is repositioning itself by selling low-quality office buildings and acquiring niche industrial properties, like industrial outdoor storage. Although the market hasn’t yet rewarded these efforts, Dave Waters expects a re-rating once industrial assets make up more than half of the company's income. Meanwhile, Peakstone offers a very high cash flow yield (20%+), providing resilience even amid rising interest rates.

CBL Properties (CBL) is a mall REIT focused on strengthening its portfolio by selling weaker malls, paying down debt, and reinvesting in its best assets. Despite malls being extremely out of favor, CBL’s smart repositioning strategy and high cash flow yield (also over 20%) make it a compelling value play that can better withstand pressure from rising interest rates.

My willingness to invest in out-of-favor sectors and situations is built on a belief that every asset has its price. Definitionally, the value of an asset has a zero bound. So, even the most distressed company facing the biggest obstacles and uncertainties can be an opportunity at some price (a very, very low one!) And every now and then, the market serves up just such an opportunity.

Q1 2025 Arquitos Capital Letter Summary

If you like special situations, you should follow Steven Kiel of Arquitos Capital.

(BTW, I just launched a special situations ebook to learn how to invest in these kind of situations. So, if you feel lucky, grab your copy HERE).

In the letter, Steven discusses the disruptive impact of new tariffs, predicting severe supply chain issues later this year once companies work through their elevated inventories.

I have read and listened to nearly one hundred earnings calls over the past six weeks from companies across a wide range of industries. Many of these companies increased their inventories in Q4 and the beginning of Q1 in anticipation of disruptions. Taken as a whole, many have now paused shipments from China specifically, and also from other countries. This includes finished products, components, and raw material inputs.

Because these companies have built up inventory, the consequence of these tariff polices won’t fully take effect until that inventory is burned off. Once that happens, we will likely see severe supply chain disruptions that may rival what happened during COVID. In the meantime, most of these companies have already begun to raise end-market prices. If their end-markets are consumers, this inflation will show soon. If the end-markets are businesses, these costs will work their way through the system and hit consumers later this year.

As investors, we only react to public policies, we don’t make them. We have to play the hand that we are dealt. Obviously the scenario above is extremely bearish for the economy and markets in general, but this will also likely create some extremely attractive opportunities for those of us who are focused on special situations. Volatility is our friend.

Comments on Holdings

ENDI Corp (ENDI): The company had a great 2024, including an 87% increase in assets under management and a 68% increase in revenue. A major catalyst occurred when ENDI sold 25% of its CrossingBridge subsidiary for $26 million, valuing the business far above the current share price. Steven Kiel believes the stock remains significantly undervalued relative to its growth trajectory.

Finch Therapeutics (FNCH): The company is a legal special situation awaiting a post-trial decision on royalties and potential enhanced damages. While the judgment has been delayed beyond Q1 expectations, the judge rejected a request to overturn the jury decision, setting a firm floor for Finch’s valuation. Depending on the outcome, Finch shares could be worth between $25 and $75, well above the current trading price of $14.35.

Nam Tai Property (NTPIF): The company made major progress in early 2025, securing new financings totaling approximately US$111 million and selling a non-core property above appraisal value for US$31 million. These developments allow the company to restart stalled construction projects and refinance debt. With shares rising from $4.75 to $5.73 during Q1 and more asset unlocks expected, Kiel believes the large gap between Nam Tai’s market price and fair value should begin to close this year.

Liquidia Therapeutics (LQDA): Liquidia is nearing the end of its long regulatory journey, with the FDA expected to approve its inhaled therapies for pulmonary hypertension (Yutrepia) by the PDUFA date of May 24, 2025. The company has experienced improved responsiveness from the FDA under the current administration, and Kiel is optimistic that approval is imminent. Liquidia’s operations are unaffected by tariffs or major supply chain risks, strengthening the investment case.

Q1 2025 Giverny Capital Letter Summary

During downturns it is worth remembering that we do not own lottery tickets. We own shares of outstanding companies, nearly all of which have strong competitive positions, long histories of sustained growth and capable management teams. In the short run, their stock prices may gyrate wildly. In the long run, their valuations will be determined by the durability of their earnings growth. Just because the market quotes an awful price for our shares on a given day does not mean we have to sell on that day.

Nobody wants to live through a hurricane but if one is coming, I believe we have a well-built home. In flush periods, when capital is plentiful, strong balance sheets may seem defensive. In a storm, the balance sheet can become an offensive weapon.

(BTW, I just launched a quality investing ebook to learn how to invest in these kind of situations. So, if you feel lucky, grab your copy HERE).

In the quarterly letter, David Poppe, president and co-founder of Giverny Capital Asset Management, states that Trump’s desire to bring manufacturing back to the U.S. is a noble goal, but his approach is poorly conceived and recklessly implemented. Instead of targeting trade abusers or incentivizing reshoring through long-term policies, Trump imposed tariffs even on America’s allies and closest partners. Poppe calls this logic flawed, especially the idea that all trade deficits are bad, using examples like importing bananas from poorer countries to illustrate how trade can benefit both sides.

He warns that exiting global trade agreements without a practical transition plan will likely lead to higher prices, supply chain disruptions, and a weaker U.S. economy, which in turn would drag down corporate profits and stock prices. Poppe also criticizes the lack of internal debate in Trump’s circle, noting that the stock and bond markets “spoke the truth” by reacting so negatively to the policy.

Ultimately, Poppe believes that a crisis caused by poor policy choices can be reversed, but only if there is a return to thoughtful, stable governance. He expresses concern about the implosion of trust in U.S. leadership both at home and abroad, warning that a predictable and lawful investment environment is essential for strong capital markets.

Because stock prices are driven over time by profit growth, the current tariff plan probably would translate to a less robust stock market.

Comments on Holdings

Giverny exited Lumine Group (CVE: LMN), a vertical software company spun off from Constellation Software, due to its small size, illiquidity, and continued control by Constellation. While the business itself is fine, Poppe believes it's more efficient to focus directly on Constellation rather than its tiny offshoots.

Poppe sold Five Below (FIVE) after the retailer strayed from its core value proposition of selling sub-$5 items. Management's move into higher-priced goods diluted its niche appeal and increased competition with mass retailers like Walmart. Leadership turnover and vulnerability to Chinese tariffs further weakened the investment case.

The position in Carmax (KMX) was trimmed due to stagnant market share and rising competition from Carvana. Though Poppe still likes Carmax's customer-centric approach, he acknowledges that despite investments in digital infrastructure, it hasn’t delivered the expected results in a rapidly evolving used car market.

After a major gain—273% since inception—Giverny trimmed its stake in Progressive (PGR). The insurer remains a core holding, and Poppe continues to view it as a strong performer with solid fundamentals, but the decision to take some profits was made after significant appreciation.

Giverny initiated a small position in TWFG (TWFG), a tech-enabled insurance platform for independent agents. Poppe admires founder Gordy Bunch's vision and sees TWFG as a scalable solution to the challenges faced by traditional captive agents in a changing insurance environment.

Aaon (AAON) was added following an earnings miss that temporarily dropped the stock. The company produces semi-custom HVAC units with superior energy efficiency, and its BASX division (cooling solutions for data centers) is growing fast. Regulatory shifts have also improved its cost competitiveness.

David sees value in Builders FirstSource (BLDR) as a dominant distributor of building products, increasingly offering off-site construction solutions to counter labor shortages. The company has executed aggressive buybacks, slashed its share count nearly in half, and is well-positioned for when housing demand rebounds.

Giverny added to Arista Networks (ANET) after a sharp decline tied to investor skepticism over AI infrastructure ROI. Poppe remains bullish on Arista’s role in powering cloud and AI data centers, seeing the drop as a buying opportunity in a long-term secular growth story.

Medpace Holdings (MEDP), a clinical trials service provider, saw its position increased. Despite concerns about FDA hostility toward drug development, Poppe highlights Medpace’s founder-led model, strong balance sheet, and buyback history as key reasons for holding through near-term uncertainty.

Kinsale Capital Group (KNSL) is a long-term holding that was added to during the quarter. Poppe praises its focus on excess and surplus lines insurance, operational efficiency, and disciplined underwriting under founder-CEO Mike Kehoe. He sees continued growth potential and strong fundamentals.

I don’t think I add much value to your lives by writing about policy making, but the current tariff drama may affect our investing lives together for years. The market has spoken and its message was clear: Trump’s tariff policies, if implemented, would not be good for the markets. Well-functioning capital markets depend on predictability and trust, which is buttressed by the even-handed enforcement of the law, including trade agreements. We are seeing, in real time, an implosion of trust in the United States both internally and among our allies. If allowed to stand, this will create a less favorable investing environment for all of us.

Q1 2025 Gate City Capital Letter Summary

Another great micro & small caps investment firm, run by Michael Melby, CFA.

As we research companies and industries that are impacted by tariffs, we have attempted to utilize estimates regarding the elasticity of demand (or the extent that an increase in the price of a product reduces market demand for that product) to project the impact tariffs could have on the price and volume of imported goods. While many exporters claim that they will pass on the full cost of the tariff to their customers, economic theory suggests the cost of any tariff is borne by both the producer and consumer according to the good’s elasticity of demand. The consumer will bear the majority of the price increase for tariffs on inelastic goods (such as gasoline) while producers will bear the brunt of the price impact for tariffs on elastic goods (such as apparel). In each scenario, fewer goods are sold while the ultimate price increase ends up being less than the full tariff as high-cost suppliers exit the market. Our portfolio has a mix of companies with some being harmed by tariffs with others being potential tariff beneficiaries. While almost all companies would be negatively impacted by a tariff-induced economic slowdown, our investment process focused on domestic companies with clean balance sheets and significant amounts of owned properties and equipment should fare better than most companies should the current tariffs be extended well into the future.

Comments on Holdings

Intrepid Potash (IPI) was the fund’s top performer in Q1 2025, benefiting from a 10% U.S. tariff on Canadian potash, which raised prices for its domestically produced fertilizer. The company also owns over 60,000 acres in New Mexico’s Permian Basin, where nearby land sales suggest its South Ranch property alone may be worth over US$100 million. With a current EV of US$333 million an d a market cap of US$375 million, Gate City sees significant upside—targeting $39.35 per share, or about +40% from current prices.

Alico (ALCO) is Gate City's largest holding, rose during the quarter after announcing its exit from citrus operations. The company plans to convert 75% of its 50,000 citrus acres to other crops and the remaining 25% to real estate developments, including a 4,500-acre master-planned community near Fort Myers. It also launched a US$50 million buyback program, suggesting confidence in upcoming land sales. Gate City values Alico at $51 per share, implying nearly 80% upside.

Saga Communications (SGA) contributed positively to performance. The company owns 113 radio stations and holds valuable real estate and broadcast infrastructure. Gate City previously initiated a governance push but withdrew its board nominations. Nonetheless, they continue to see deep value in Saga’s assets and believe potential deregulation of FCC ownership caps could spur industry consolidation. With a market cap of US$71 million and EV of just $48 million, the firm sees 70% upside to their $19.22/share target.

Dorel Industries (DII.B) was the portfolio’s largest detractor. Its Home division, currently restructuring, posted poor results and faces tariff risks. However, its Juvenile segment (car seats and strollers) has been profitable for three years, owns a major U.S. plant, and may benefit from tariffs on Asian imports. Gate City believes Dorel Juvenile could be sold at a premium, but for now the stock remains undervalued at a market cap of US$38 million and an EV of US$220 million.

Helix Energy Solutions (HLX) declined due to falling oil and gas prices, pressured by tariff fears. Despite short-term headwinds, Gate City remains bullish thanks to Helix’s strong backlog, healthy balance sheet, and free cash flow yield over 20%. They note the company's valuation is attractive (under 3x EV/EBITDA), and geopolitical instability and low U.S. oil reserves could eventually support energy prices. Gate City targets $14.85/share—more than 120% upside from current levels.

The Case of Mosaic Co

Gate City initiated a position in Mosaic Co during the quarter after following the company for years (almost 10 years!). Despite being larger than their typical investment, Mosaic’s deep undervaluation, essential products, and competitive position made it compelling.

Mosaic is North America’s largest phosphate fertilizer producer and second-largest potash producer, with vertically integrated operations spanning mines, processing plants, ports, and warehouses. It also controls a dominant share of Brazil’s fertilizer market through its Mosaic Fertilizantes division.

We have rarely uncovered companies like Mosaic that operate with duopoly-like competitive structures for essential products at such an attractive valuation.

In addition to its core operations, the company owns a range of valuable non-core assets. These include a US$1.3 billion stake in Saudi mining conglomerate Ma’Aden, over 300,000 acres of land in Florida (more than six times the land owned by Alico), and various infrastructure holdings such as terminals, warehouses, and ports. Mosaic has also announced plans to divest non-core operations, including its langbeinite mine in New Mexico.

Gate City views the company’s assets as providing a substantial margin of safety, especially in a volatile macroeconomic environment. They also found Mosaic’s leadership team focused on disciplined capital allocation, return on investment, and maximizing free cash flow, signaling a shift toward more shareholder-friendly practices.

Gate City estimates Mosaic’s fair value at $43.50 per share—about 61% above its current price—based on a DCF analysis and valuation of its operating and non-operating assets. They argue that the company’s exposure to rising global fertilizer prices, especially in the context of recent tariffs and renewed cooperation between Russian and Belarusian producers, offers strong tailwinds.