Why Every Investor Needs a Post-Mortem Analysis (And How to Do It Right)

Learn how to use post-mortem analysis to review your investments, avoid repeating mistakes, and improve your long-term investing strategy.

TL; DR

A post-mortem analysis helps you review past investments to identify mistakes, missed opportunities, and improve decision-making.

Mohnish Pabrai uses post-mortems to refine his investment strategy, avoid biases, and document lessons learned.

Being honest and systematic in your reviews can help you become a more disciplined and successful investor.

When investing, it's always a good idea to write down what led you to make the decision. After selling a position, you should analyze it thoroughly—understand what led you to buy it in the first place.

This process is called a Post-Mortem Analysis, and you should conduct it in the following cases:

You made or lost money

Your analysis was flawed

You fell into behavioral biases

A post-mortem analysis is a reflective exercise conducted after exiting an investment position to analyze the decision-making process and understand what led to the outcomes. Rather than simply looking at the result (profit or loss), a post-mortem analysis digs into the original investment thesis, the conditions surrounding the decision, and any missed red flags or opportunities. This structured reflection is invaluable for reinforcing discipline, improving investment processes, and fostering continuous learning.

The goal of the post-mortem analysis is to identify any gaps in research and analysis to improve the investment process, reduce the chances of repeating the same mistakes, and maintain consistency in your investment approach.

Keep in mind that a post-mortem analysis requires you to be honest and open with yourself, recognizing both your successes and failures.

Mohnish Pabrai and the Importance of Post-Mortem Analysis

Value investor Mohnish Pabrai places high importance on post-mortem analysis as part of his investment process. He uses post-mortems to systematically review and learn from his mistakes and successes, ensuring that each investment outcome contributes to his continuous improvement as an investor.

Here’s how Pabrai incorporates post-mortem analysis into his investment approach:

Systematic review of mistakes: Pabrai meticulously examines each decision to understand the factors that led to undesired outcomes. For him, the post-mortem is not just about identifying the surface-level reasons for a loss but uncovering deeper insights into what went wrong in his research, assumptions, or timing. This methodical review helps him avoid repeating the same mistakes, building a more resilient investment framework.

Focus on learning, not blame: Similar to Munger’s approach, Mohnish views mistakes as learning opportunities rather than failures. He is known for saying, “We don’t learn from our successes, we learn from our mistakes.” This attitude allows him to approach the post-mortem analysis objectively, focusing on process improvements rather than regretting or blaming external factors.

Enhancing investment process and mental models: Through post-mortem analysis, Pabrai refines his mental models and investment process. Each misjudgment or overlooked factor serves as a foundation for enhancing his analytical methods, research depth, or risk management approach.

Documenting decisions for reflection: Mohnish keeps detailed records of his investment decisions, documenting his thesis, assumptions, and expected outcomes. These records form the basis of his post-mortem analysis, providing an unaltered view of his mindset and rationale at the time of the decision. This documentation is essential for comparing initial expectations with actual results, helping him to clearly see where misalignments occurred.

Recognizing behavioral biases: Pabrai’s post-mortems also focus on identifying behavioral biases, such as overconfidence or anchoring, that might have affected his judgment. By examining his behavior during the decision-making process, he becomes more aware of biases that could have clouded his analysis, enabling him to adjust his approach in the future.

Building a “Checklist of Failures”: Inspired by his post-mortem findings, Mohnish creates a personalized “checklist of failures.” This checklist includes potential pitfalls he has encountered in the past, such as underestimating competition or overrelying on favorable market conditions. This proactive checklist serves as a reminder to avoid similar mistakes in future investments.

Pabrai’s example of a post-mortem analysis

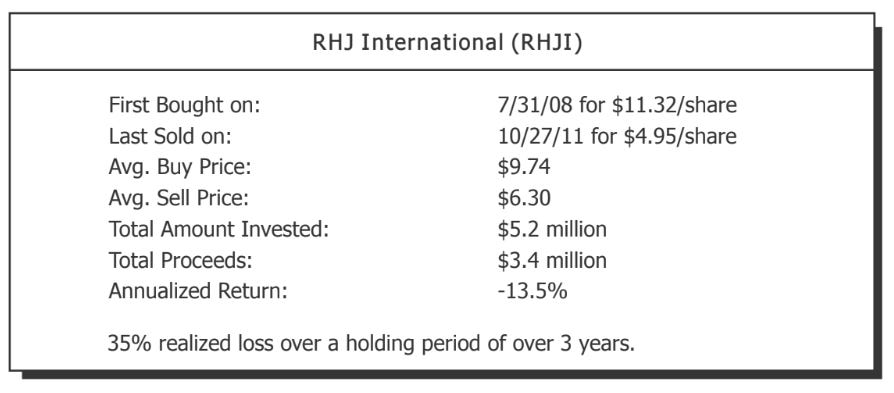

Here’s an example of a post-mortem analysis from Mohnish Pabrai in his 2011 annual letter. The company was RHJ International (RHJI):

The bad news about our RHJI investment is that the funds lost money. The slightly better news is that it was a small investment and the aggregate dollars lost was under $2 million. Investing in RHJI has taught me a few valuable lessons that have already proved to be quite helpful.

RHJ International is a Belgium-based holding company promoted by Timothy C. Collins. In the 1990s Tim Collins and J. C. Flowers bought out and then spectacularly turned around Shinsei Bank in Japan. Their remarkable experience, as unwelcome foreigners in Tokyo doing an LBO and then restructuring a prominent Japanese commercial bank is well chronicled in a wonderful book called Saving the Sun by Gillian Tett.

After his buyout of Shinsei, funds controlled by Collins had amassed stakes in a number of public and privately held Japanese businesses and assets. In March, 2005 these were contributed by Collins to the newly formed RHJ International, which went public through a simultaneous IPO and private placement. Tim Collins purchased approximately $50MM of RHJI shares at the time of the IPO (at €19.25 per share) and owned 11%+ of the company. He committed to a five-year lock-up on his shares. The driver for RHJI’s incorporation in Belgium is a favorable provision contained in the Belgium-Japan tax treaty. Sales of Japanese shares by RHJ are not subject to capital gains taxation in Japan or in Belgium.

Collins had a stated objective of making RHJI his “Berkshire Hathaway.” I was attracted to RHJI due to the compelling value and prospects. Cash equaled 83% of the market cap. The remaining 17% (being ascribed a value of €100 million at the time) included stakes in seven publicly traded Japanese businesses (worth over €230 million), significant stakes in two privately held Japanese businesses (worth over €315 million at cost) and the Phoenix Seagaia Resort in Japan’s southernmost island, Kyushu. The resort has over 10 kilometers of Pacific Ocean frontage and 750 acres of pine forests. It includes a five star hotel, a number of 2/3 star hotels, four golf courses, one of the largest convention centers in Japan, an indoor water amusement park, tennis club, bowling, etc. The resort had cost over $2 billion to build out. It was carried on the books at about €130 million.

There was RHJI’s €586 million market cap on one hand. On the other side was a smorgasbord of assets listed above that were arguably worth at least €675 million. Add to that the €486 million of cash and one was paying fifty cents for a dollar of assets. More importantly, some 42 cents of that dollar was in cash with some pretty savvy capital allocation prowess at the helm. How could I miss?

Well, I did miss. Here is why. As stated earlier with the St. Joe and Tejon Ranch examples, the Seagaia Resort is far from prime real estate. One cannot value it on the cost basis of $2 billion or even what Collins paid for it. Even before the financial crisis, it was generating low single digit millions in free cash flow. This appears to be a white elephant that is not worth much. So, that’s the first mistake. I should have focused on the resort’s historic free cash flow instead of cost basis or purchase price. And given its non-prime nature I should have discounted that value even further.

Nearly all of the remaining businesses are in the auto parts industry. The entire industry imploded during the financial crisis and these businesses struggled with debt service and keeping the lights on. Plenty of value destruction took place within the RHJI portfolio in 2008-2009.

The good news (if one can call it good news) is that RHJI purchased Kleinwort Benson in July 2010 for €256 million. Anti trust authorities required Commerzbank to sell Kleinwort in order to complete another acquisition. RHJI picked up a storied top flight conservative bank at a good price from a forced sale. They also brought on board a stellar leader, Leonhard Fischer, to run it all.

There is only so much one can expect Leonhard to do when facing massive headwinds. European Banks became among the most distressed of asset classes as the European sovereign debt and banking crisis went into overdrive in 2011. And if that wasn’t enough, the tsunami in March 2011 brought Japan’s auto industry to its knees. RHJI had seen its cash pile dwindle and no one was interested in some Belgian conglomerate with a bunch of distressed Japanese auto assets and a European bank.

I had held RHJI for a solid 3+ years and it had been a disappointment. It is entirely possible that I sold out at the wrong time and the business may well be valued considerably higher in the years ahead. However, the funds were getting 65% of our capital back and I preferred to throw in the towel and re-invest the same into vastly more compelling opportunities available to us at the time.

(If you want to check Pabrai’s post-mortem analysis from his 2011 letter, here’s the PDF with 4 examples)

How to make your own Post-Mortem Analysis

Mohnish proudly claims to be a ‘shameless cloner’. So let's clone the structure of his post-mortem analysis:

1. Start with a table with the info of your trade:

Name of the company & stock ticker

First bought on (date & purchase price)

Last sold on (date & purchase price)

Avg. buy price

Avg. sell price

Total amount invested

Total proceeds (losses)

Annualized return

2. Review the original investment thesis

Revisit the initial reasoning, including:

The rationale behind the investment decision

Key assumptions and expected outcomes

Any relevant industry or market factors at the time

3. Analyze key variables and missed signals

Assess any unexpected events or missed indicators that influenced the investment’s outcome, such as:

Changes in company performance or market conditions

Missed red flags or alternative data sources that could have provided additional insights

Opportunities to adjust the investment or exit sooner

4. Evaluate execution and timing

Reflect on the timing of entry and exit points, as well as any deviations from the initial strategy. This analysis helps identify improvements in decision timing and trading execution.

5. Document lessons learned

Summarize insights gained, including:

Changes to improve the investment process

Adjustments to research methods, valuation criteria, or risk management

Personal behavioral patterns that impacted the decision, such as overconfidence or recency bias.

6. Implement changes and follow-up

Create a plan to address the identified lessons. Assign a follow-up date to review the progress of these changes and ensure they are incorporated into future decisions.

Want to run your own Post-Mortem Analysis?

If you are confused with the post-mortem analysis structure, don’t worry, I’ve got you covered.

I put together a simple checklist that you can use for FREE.