Litigation Capital Management (LIT): A Mispriced Litigation Finance Play with 40% Upside

LIT is a mispriced litigation finance firm transitioning from a volatile case-by-case funding model to a more predictable asset management structure

Executive Summary

Litigation Capital Management (LSE: LIT) is a mispriced litigation finance firm transitioning from a volatile case-by-case funding model to a more predictable asset management structure. The stock has sold off due to HY25 case losses and a temporary revenue drop from A$21.6M to A$4.7M, despite LCM’s historical MOIC of ~2x and strong IRR. The market’s overreaction to short-term losses, failure to recognize LCM’s asset management (M) transformation, and underappreciation of its U.S. expansion create a compelling long opportunity.

At a P/B of 0.7x, LCM trades at a 40% discount to its adjusted book value of £0.89/share and well below peers Burford Capital (1.3x P/B) and Omni Bridgeway (1.5x P/B). The company’s Fund III launch in Q2-Q3 2025 will unlock stable management fee revenues, while upcoming arbitration recoveries and U.S. expansion provide additional upside catalysts.

Company overview

Founded in 1998, LCM is an Australian-based litigation finance company specializing in funding legal disputes in exchange for a share of the final recovery. The company operates in the fast-growing alternative asset class of litigation finance, providing non-recourse capital to claimants, law firms, and corporations. Its funding model ensures that LCM bears the litigation costs and receives a pre-agreed portion of the case proceeds only if the legal action is successful. This structure mitigates financial risk for claimants and allows them to pursue legal claims without upfront costs.

Initially, the company solely financed legal disputes using its own balance sheet capital. However, in 2020, the company pivoted toward an asset management model to accelerate its expansion. Today, LCM funds legal cases through two primary models:

1. Direct Balance Sheet Investments: Deploys its own capital to finance cases, assuming full risk and reward. This approach offers greater control over case selection but limits scalability due to capital constraints.

2. Third-Party Asset Management: Raises capital from institutional investors, contributing approximately 25% of the funding while external investors provide the remaining 75%. This structure enables greater diversification and recurring fee income from fund management, reducing reliance on unpredictable case resolutions.

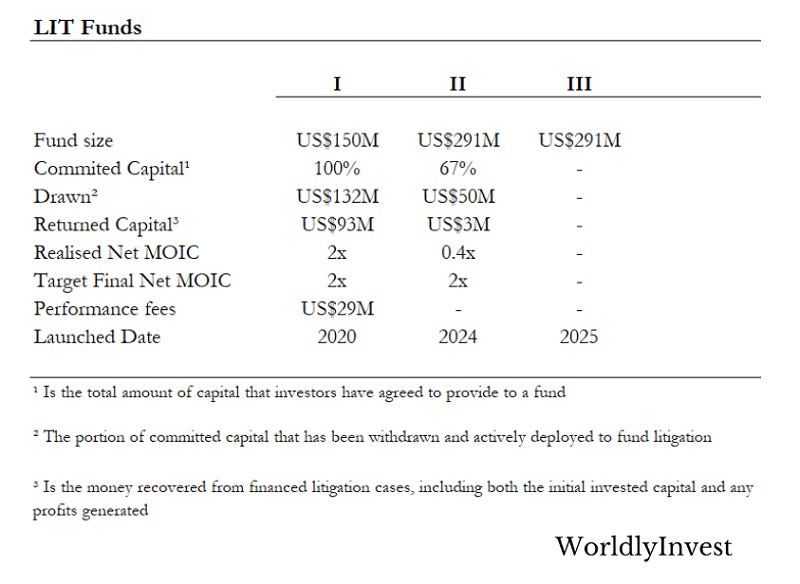

To date, LCM has raised two litigation finance funds, accumulating approximately US$441 million in assets under management (AUM), with a third fund currently in development. This transition to AM has positioned LCM to scale more rapidly and participate in a broader range of high-value litigation cases while stabilizing cash flows through management and performance fees.

The company operates in multiple litigation categories, with its portfolio primarily focused on:

Class Actions (#1 segment) – Large-scale claims that allow groups of claimants to collectively seek damages.

International Arbitration (#2 segment) – High-stakes disputes, often involving cross-border corporate litigation.

Insolvency Claims (#3 segment) – Cases arising from corporate bankruptcies and financial distress.

It has expanded its geographic footprint to capitalize on the rising demand for litigation funding. It maintains a strong presence in the United Kingdom (UK) and Europe, where regulatory developments have created a favorable environment for third-party litigation finance. Additionally, Asia-Pacific (APAC) remains a core region, supported by the growing acceptance of litigation funding in Australia and emerging Asian markets.

One of LCM’s strategic objectives is penetrating the U.S., the world’s largest litigation finance market, valued at US$156 billion. While competition in the U.S. is fierce, LCM’s disciplined approach to case selection, combined with its ability to co-invest alongside institutional investors, positions it to scale effectively in this market.

Revenue Model

Unlike traditional financial services firms with predictable revenue streams, LCM’s earnings are inherently volatile due to the uncertainty surrounding litigation outcomes. Revenue primarily stems from two sources:

Litigation Investment Returns: Capital gains from successful legal case resolutions.

Fund Management Fees: Stable income derived from management and performance fees on third-party funds.

Cash flow variability is a defining characteristic of litigation finance. Since cases often take several years to resolve, operating cash flows are highly irregular, with inflows occurring in large lump sums upon case settlements. Meanwhile, investing cash flow remains consistently negative due to ongoing case funding commitments. LCM’s ability to raise external capital through its asset management division ensures liquidity and enables continuous investment in new cases despite prolonged case durations.

Industry Overview

The global litigation finance industry has experienced rapid expansion, driven by increasing legal costs, corporate demand for risk-sharing, and evolving regulatory landscapes that favor third-party funding. Market Research Future estimates that the industry will grow from US$25.84 billion in 2025 to US$59.58 billion by 2034( CAGR of 9.6%). The U.S. remains the largest market, followed by APAC and Europe, while Latin America and Africa represent emerging opportunities.

The industry is considered economically resilient as legal disputes persist irrespective of macroeconomic conditions. In downturns, financial distress, bankruptcies, and corporate disputes tend to rise, fueling demand for litigation funding. Additionally, companies and individuals often seek external funding during periods of financial uncertainty, further bolstering the need for third-party litigation finance.

Challenges

Despite its growth potential, the litigation finance industry faces several challenges:

Regulatory uncertainty: Jurisdictions vary in their treatment of third-party litigation funding, and changes in regulation could impact profitability.

Long case durations & unpredictable cash flows: Litigation cases often take years to resolve, leading to inconsistent revenue and cash flow volatility.

Rising competition: Institutional investors and new entrants are putting pressure on fees and deal terms, making high-quality case selection critical.

Reputational & ethical risks: Critics argue that litigation finance may encourage frivolous lawsuits or unnecessarily prolong disputes.

Rising capital costs: Increasing interest rates and capital costs could make it more expensive for litigation funders to raise new funds.

Growth Drivers

Several factors are propelling the industry’s expansion:

Rising legal costs: Increasing legal fees make litigation finance a more attractive option for claimants who cannot afford to self-fund lawsuits.

Greater corporate adoption: More corporations are using litigation finance as a strategic tool to manage legal risks and free up capital for core operations.

Regulatory clarity in key markets: Jurisdictions such as the U.S., UK, and Australia are providing clearer guidelines on third-party funding, increasing institutional investor participation.

Expansion of class actions & international arbitrations: A growing number of high-value disputes across multiple geographies is fueling demand for litigation funding.

Technology & AI in litigation risk assessment: Advanced data analytics and AI-driven case evaluation tools are improving risk management and underwriting efficiency.

Shift toward AM-based models: Raising institutional capital instead of relying solely on balance sheet investments is improving scalability and reducing risk exposure.

Competitive Landscape

LCM operates in an industry that is neither highly fragmented nor fully consolidated. The market is characterized by a mix of small niche players and a few dominant publicly traded litigation finance firms. Key publicly traded competitors include:

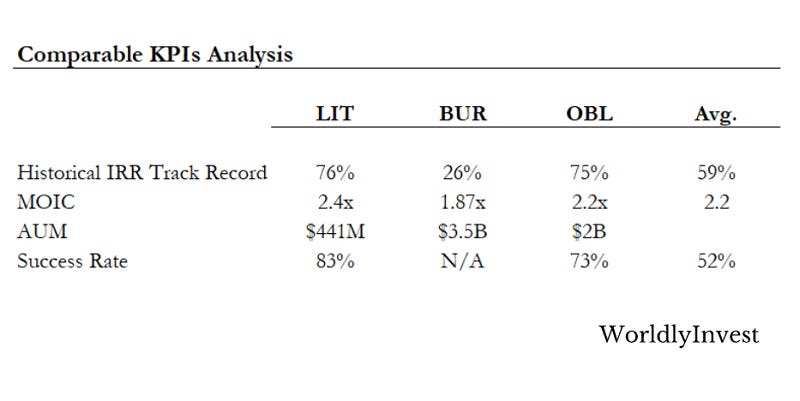

Burford Capital (LSE: BUR): The global industry leader with US$3.5 billion in AUM but a declining financial performance, marked by a 70% drop in revenue over the past 3y and a lackluster historical IRR of 26%.

Omni Bridgeway (ASX: OBL): A well-established competitor with US$2 billion in AUM and a significantly higher IRR track record (75%) and MOIC (2.22x) than Burford.

LCM differentiates itself by targeting smaller, high-return cases that larger players often overlook due to their capital size. This focus on niche opportunities provides an advantage in achieving superior risk-adjusted returns.

Moats

Switching costs: With over 25 years of experience, LCM has built a strong reputation and deep industry relationships with top-tier law firms, corporations, and institutional investors. Law firms and claimants prefer working with litigation funders that have a proven track record, reinforcing a virtuous cycle of deal flow. Additionally, LCM’s proprietary database of historical case outcomes provides it with unique insights into litigation risk, enabling superior underwriting and pricing decisions compared to newer entrants.

High Barriers to Entry: The litigation finance industry demands substantial financial resources due to the long investment horizon before returns materialize. Moreover, deep legal expertise is essential, as underwriting cases requires specialized knowledge of legal precedents, jurisdictional differences, and risk assessment. The lack of publicly available case data makes it difficult for new entrants to develop effective underwriting models, further strengthening the competitive advantage of incumbents like LCM.

Management & Capital Allocation

LCM’s leadership team is anchored by Patrick Moloney (CEO since 2013), who has been with the company since 2003. He is the largest insider shareholder, with 9% ownership, while Chairman Jonathan Moulds holds 4.5%. Insiders collectively own 17% of the company, aligning their interests with long-term shareholder value creation.

Management compensation consists of a mix of base salary, performance-based bonuses, and long-term equity incentives (LTIPs). LCM’s LTIP structure vests over 3-5 years and includes clawback provisions, reinforcing accountability. However, executive compensation as a percentage of revenue is 6.6%, notably higher than competitors Burford (5.87%) and Omni Bridgeway (4.3%).

LCM has historically deployed capital through a mix of share buybacks and reinvestments into new cases. The company suspended dividends in FY2025 to allocate more capital toward growth initiatives, including litigation financing and fund expansion. A share buyback program remains in place, with A$5.4 million repurchased in 2024, signaling management confidence in the stock’s undervaluation.

Investment Thesis

Why LCM is Undervalued

Market overreaction to ST case losses: LCM’s stock has declined due to HY25 case losses and a revenue drop from A$21.6M to A$4.7M, driven by setbacks in two major Australian class actions. The market is focusing on quarterly volatility rather than long-term portfolio performance. However, LCM’s historical MOIC of ~2.0x and diversified case portfolio indicate strong long-term returns. Litigation finance cash flows are inherently lumpy, and peers like Burford Capital and Omni Bridgeway trade at higher valuation multiples despite similar short-term losses.

AM-based model is not fully priced: The company is transitioning from case-by-case funding to an AM model, earning recurring fund management fees instead of relying solely on case settlements. Despite successfully deploying Fund I (US$150M), committing 60% of Fund II (US$291M), and preparing Fund III for Q2-Q3 2025, the market still values LCM as a litigation funder rather than a growing asset manager. Litigation finance firms with AM-based models typically trade at higher earnings multiples due to their more predictable revenue streams.

U.S. expansion: LCM is expanding into the US$156B U.S. litigation finance market and implementing AI-driven case screening to improve underwriting efficiency. The market has not yet priced in the long-term benefits of these initiatives, despite evidence that larger litigation finance players, such as Burford Capital, command significantly higher valuation multiples due to their U.S. exposure. A successful U.S. expansion would significantly increase LCM’s case pipeline and revenue diversification.

Why This Opportunity Exists

Fund III launch will unlock stable fee-based revenue: LCM is preparing to launch Fund III in Q2-Q3 2025, following the success of Fund I and Fund II, which have attracted institutional capital and provided stable management fee income. As LCM continues raising external capital, it will shift further toward higher-margin, recurring revenue streams, improving earnings stability and supporting a valuation re-rating.

Upcoming arbitration recoveries can offset recent losses: The company has secured several high-value arbitration awards, including US$110M from the Indiana Resources case (with US$8.4M recoverable by LCM). If these cases result in faster-than-expected recoveries, they could provide an immediate earnings boost, reversing the negative impact of recent case losses.

U.S. market expansion will drive future growth: LCM is expanding into the U.S., the largest litigation finance market, while integrating AI-driven underwriting to improve risk assessment and scale deal flow efficiently. These initiatives, which differentiate LCM from smaller funders, are not yet reflected in its current valuation but could materially increase its case pipeline and improve risk-adjusted returns.

Valuation

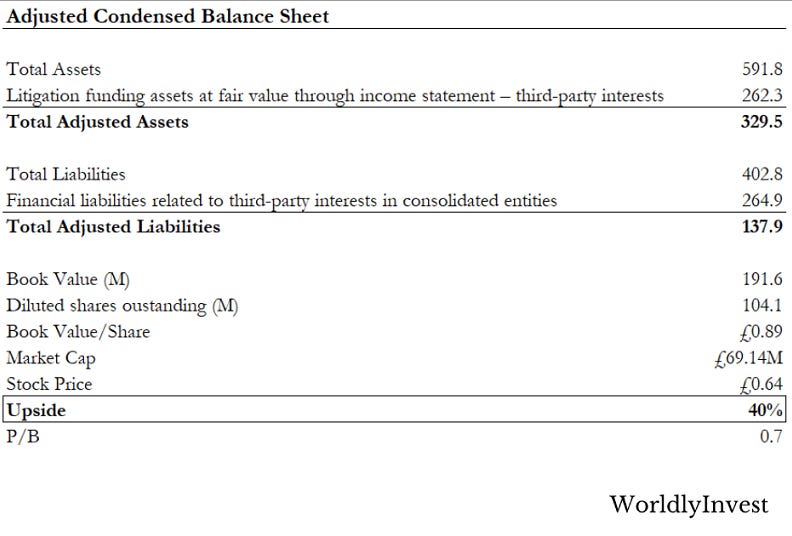

To assess LCM’s intrinsic value, we adjusted its reported book value to exclude third-party interests that obscure true shareholder equity. LCM consolidates third-party litigation funding assets (£262.3M) and financial liabilities (£264.9M), which belong to external investors rather than LCM itself. Removing these items results in adjusted assets of £329.5M and adjusted liabilities of £137.9M, leading to an Adjusted Book Value (ABV) of £191.6M. Given 104.1M diluted shares outstanding, this translates into a Book Value/share of £0.89. Compared to the current stock price of £0.64, this implies a 40% upside.

Peer Analysis

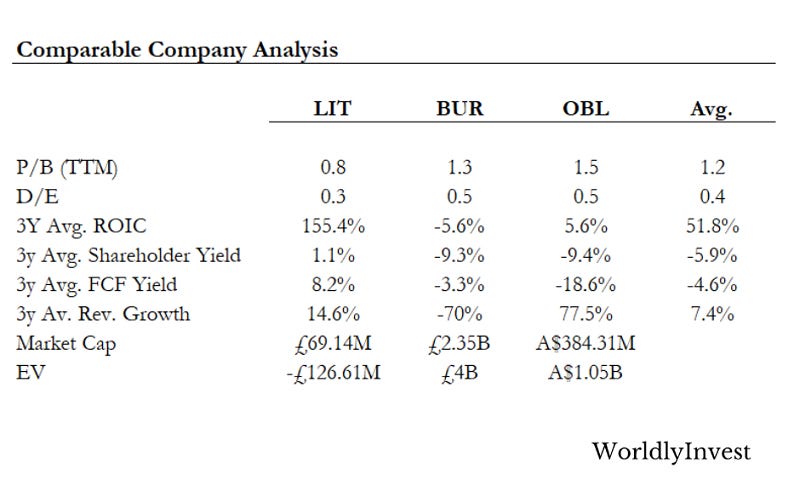

LCM trades at a P/B ratio of 0.7x, significantly lower than Burford Capital (1.3x) and Omni Bridgeway (1.5x), with an industry average of 1.2x. This valuation discount suggests potential for multiple expansion if market sentiment improves or if LCM executes its strategy effectively.

Despite its low valuation, LCM exhibits superior financial performance metrics:

3-Year Avg. ROIC: 155.4% vs. Burford (-5.6%) and Omni Bridgeway (5.6%)

FCF Yield: 8.2%, compared to Burford (-3.3%) and Omni Bridgeway (-18.6%)

Revenue Growth (3-Year Avg.): 14.6%, compared to Burford (-70%) and Omni Bridgeway (77.5%)

Additionally, LCM’s market cap of £69.14M and negative EV (-£126.61M) indicate that the market is over-discounting its financial stability and growth potential. This discrepancy suggests significant upside potential if investor sentiment improves or the company continues executing well on its litigation funding strategy.

Risks

Revenue volatility & case uncertainty

LCM’s revenue is inherently volatile, as it depends on the timing and success of litigation case resolutions. A delayed or unsuccessful case can lead to significant earnings fluctuations, making financial forecasting challenging. This was evident in HY 2025, where total income dropped to A$4.7M from A$21.6M in HY 2024, primarily due to a net fair value loss of A$32.7M. Additionally, the company faced trial losses in two major Australian class actions.

To counteract revenue volatility, LCM is shifting toward an asset management model, which provides more stable management and performance fees alongside case settlements. The company is also diversifying its case portfolio and increasing its geographic exposure to reduce reliance on any single jurisdiction or case type. A rigorous underwriting process ensures that only high-probability cases are selected for investment.

Key Monitoring Indicator: If net realized gains from concluded investments continue declining, or if asset management fees fail to offset litigation revenue shortfalls, LCM’s ability to sustain long-term growth could be at risk. Monitoring case success rates, fund performance, and new case commitments will be crucial for assessing financial stability.

Regulatory & legal uncertainty

The litigation finance industry operates in a complex regulatory landscape, and new restrictions on third-party funding could limit LCM’s ability to deploy capital or impact case profitability.

The company maintains a strong legal and compliance team to monitor evolving regulations in key jurisdictions. It also operates in multiple regions (UK, Australia, Singapore, and expanding into the U.S.), reducing exposure to any single market’s legal risks.

Key Monitoring Indicator: If new legislation restricts litigation funding in a major market (e.g., UK or U.S.) or if compliance costs significantly increase, LCM may face structural headwinds.

Liquidity & capital deployment risks

LCM requires significant upfront capital to fund cases, but case settlements can take years to generate returns, creating potential liquidity constraints. If new capital commitments slow down, it may face challenges in scaling its operations.

The company has shifted toward an asset management model, raising third-party capital through funds to reduce reliance on its balance sheet. It also maintains strict investment discipline, ensuring that capital is deployed only in high-probability cases.

Key Monitoring Indicator: If capital commitments to new funds decline or if operating cash flow remains negative for multiple periods, LCM’s ability to sustain long-term growth could be impacted.

Catalysts

Fund III launch: LCM is set to launch Fund III, with an initial close expected in Q2 2025 and a second close in Q3 2025. This fund is expected to be similar in size to Fund II (US$291M committed) and will provide a stable, recurring management fee income stream, reducing the company’s reliance on unpredictable case settlements. If fundraising exceeds expectations, it could lead to a re-rating of the stock, as fund-based revenue is more predictable and valued at higher multiples than case-driven earnings.

Expansion into the U.S.: The company is actively expanding into the US$156B U.S. litigation finance market, leveraging AI-driven investment screening to enhance case selection and underwriting efficiency. This initiative reduces investment risk while scaling case volume. Given Burford Capital’s dominance in the U.S. market, any sign of LCM securing major U.S. case commitments or partnerships could drive investor confidence and stock price appreciation. However, entering the highly competitive U.S. market may take time, requiring strong case flow and established relationships with top-tier law firms.

Hidden value in arbitration recoveries: LCM has successfully secured multiple arbitration cases, including a US$110M award in the Indiana Resources case, of which US$8.4M is expected to be recovered by the company. More significant case recoveries could materialize in the next 6-12 months, potentially boosting earnings after the HY25 revenue decline. If additional settlements or arbitration payments are realized earlier than expected, this could serve as a near-term re-rating event. However, enforcement of arbitration awards is complex, and appeals or jurisdictional challenges could delay the recovery process.

Things I Don’t Like

1. Fair value accounting: LCM reports its litigation assets at fair value, which relies on management estimates of case outcomes. This introduces subjectivity in financial reporting, as case values can be adjusted before actual settlements. In HY25, LCM recorded a net fair value loss of A$32.7M, significantly impacting reported income. While this is an industry-wide issue, it makes earnings less predictable and harder to compare across periods.

2. Cash flow volatility: The company’s operating cash flow was -A$32M in HY25, as case recoveries lagged behind capital commitments. While the company’s AM-based model is designed to stabilize cash flows, its ability to generate consistent positive FCF remains uncertain. Additionally, if institutional investors slow capital commitments to LCM’s funds, the company may face capital constraints, affecting future case funding.

3. Potential conflicts of interest in AM: As LCM expands its AM-based model, there is a potential misalignment between fund investors and public shareholders. Fund managers may prioritize securing higher management fees over optimal case selection, which could impact long-term case returns. LCM provides limited disclosures on individual fund performance, making it difficult to assess whether fee structures benefit public investors.

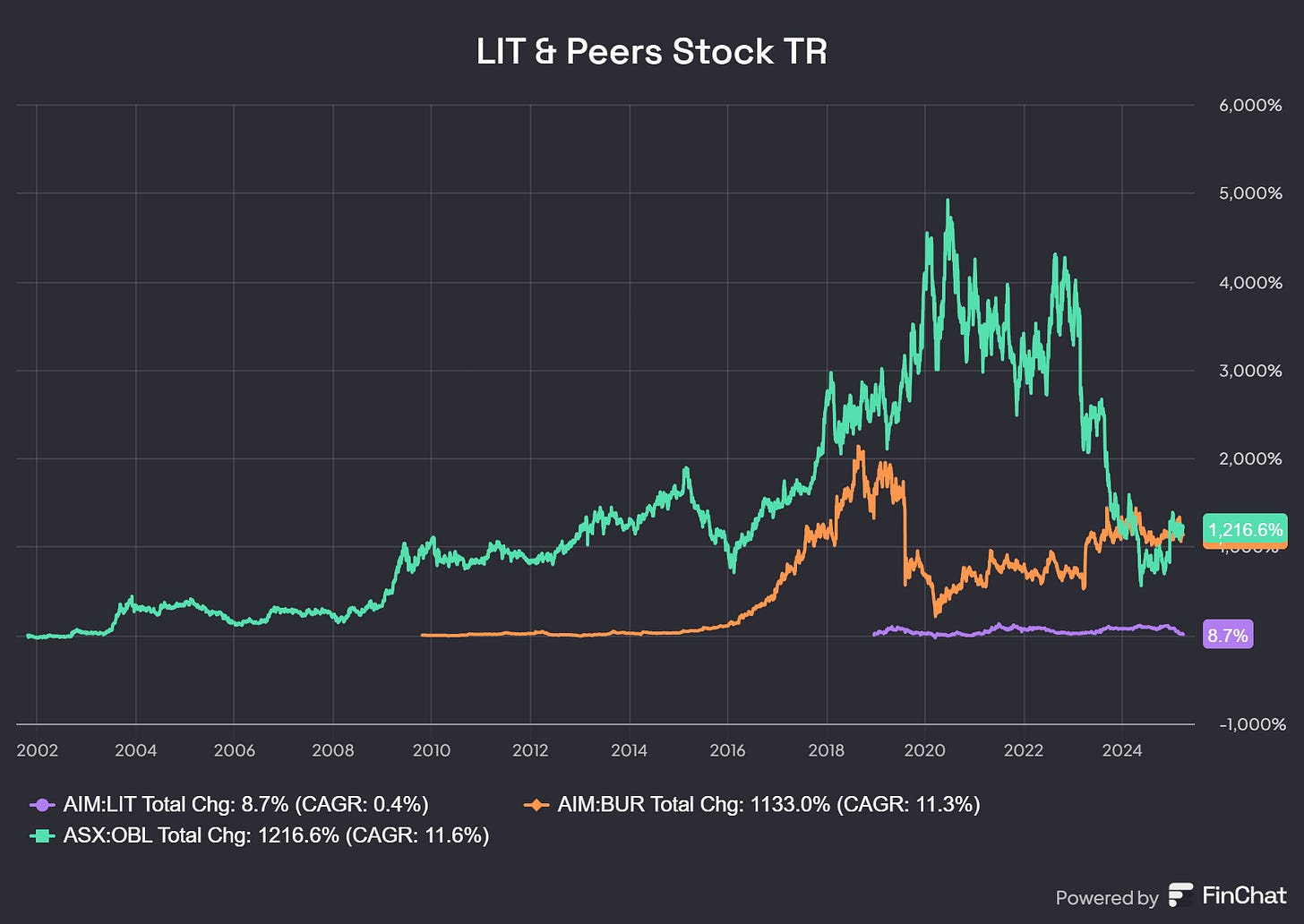

4. Mediocre total return performance: LIT’s historical total return performance has been lackluster, delivering just 8.7% in total over six years since its IPO (0.4% CAGR). In contrast, its peers have demonstrated stronger returns over the same period. However, this underperformance may be reflective of broader industry dynamics, as litigation finance stocks tend to be closely tied to the timing and success of case resolutions, which can be highly unpredictable.