I Studied 46 Columbia Business School Investment Theses—Here’s How to Write a Great One

So you can write a great investment thesis

I have been studying the winning investment theses of the 5x5x5 Russo Student Investment Fund1 for a few weeks now.

This fund, which belongs to The Heilbrunn Center for Graham & Dodd Investing of Columbia Business School (CBS), is a unique student portfolio fund that holds a limited number of stocks for a long time, reflecting the value investing tradition, and was designed and funded by Thomas Russo, partner at Gardner Russo & Gardner.

These guys are known for producing high-quality investment theses that win competitions and impress professional investors.

After analyzing the 46 theses available in their website, I’ve identified a repeatable structure you can use to improve your own investment theses.

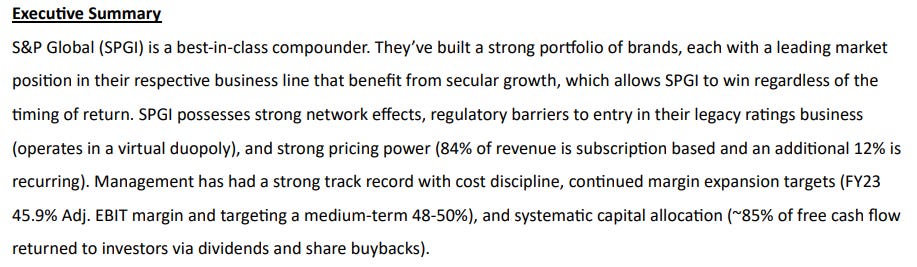

Executive Summary

Give a high-level overview of the investment opportunity in less than a paragraph.

Clearly state the company name and ticker.

Summarize why this is a good investment in one or two sentences.

Mention the price target and expected IRR (internal rate of return).

Declare if the position is LONG or SHORT.

Best practices

Keep it concise but impactful.

Include key financial metrics.

Clearly state why the market is mispricing the opportunity.

Avoid

Being too vague or generic.

Not quantifying the investment potential.

Omitting the investment rationale.

Example:

Company Overview

Explain the company’s business model and competitive position.

Brief description of the company and its industry.

Key revenue segments and growth drivers.

Competitive advantages (moat, market position, pricing power, etc.).

Financial highlights (revenue, EBITDA, margins, etc.).

Best practices

Focus on the business model and key revenue drivers.

Highlight competitive advantages.

Use recent financial metrics to provide context.

Avoid

Copying the investor relations description without adding insight.

Ignoring the competitive landscape.

Failing to provide relevant financial data.

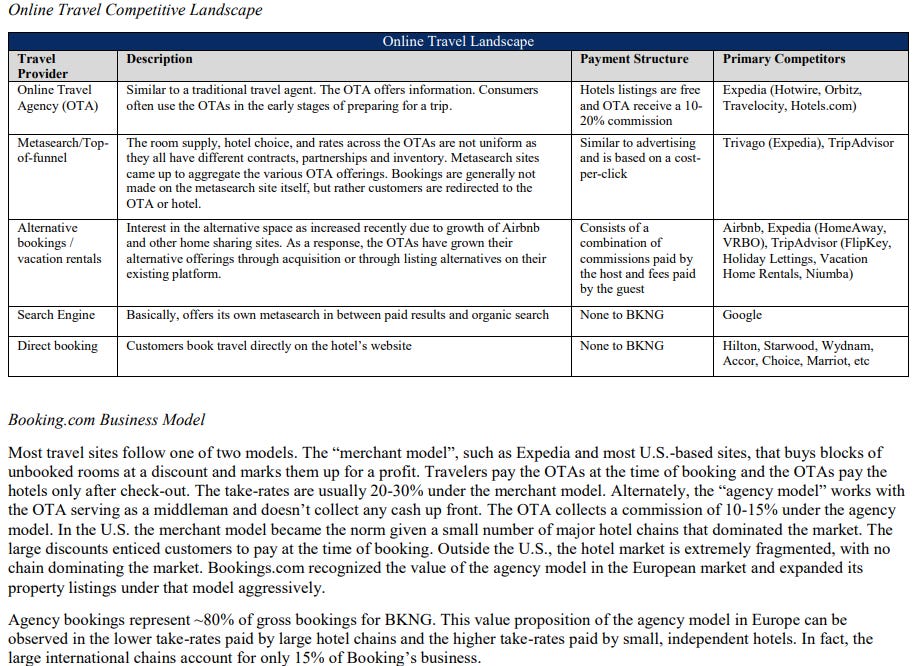

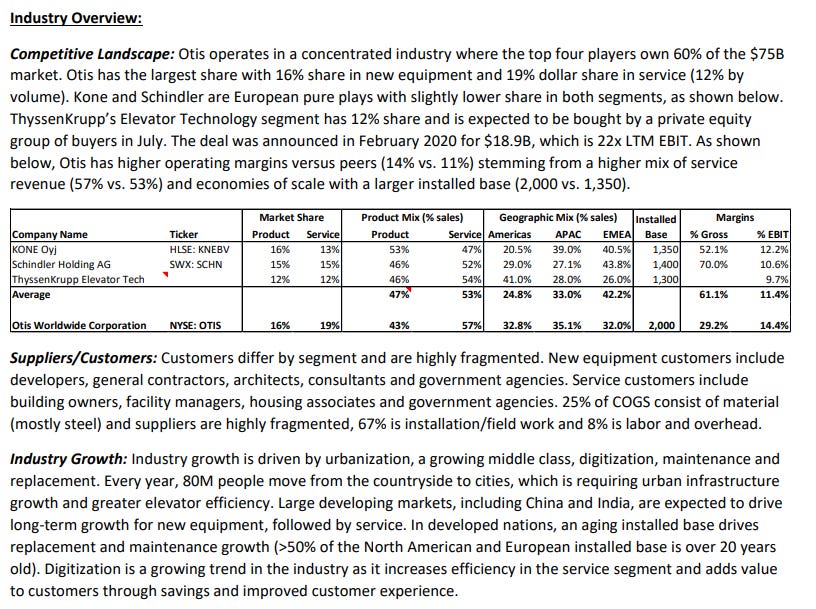

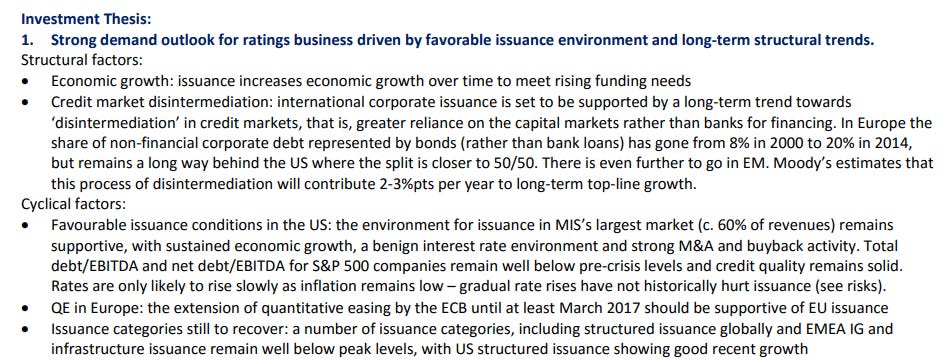

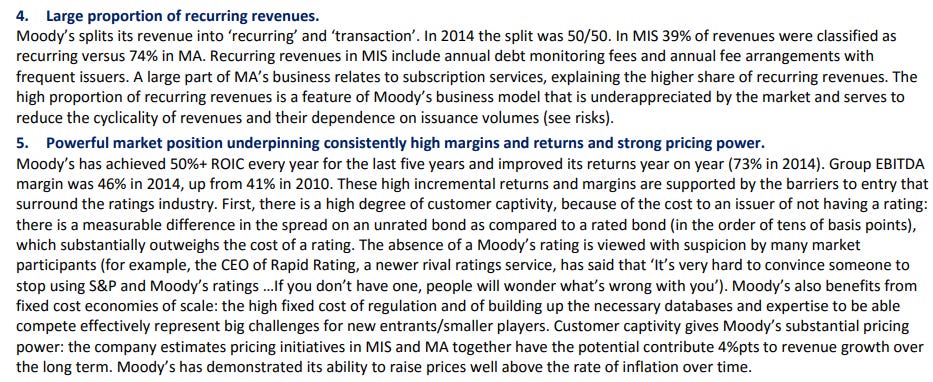

Example:

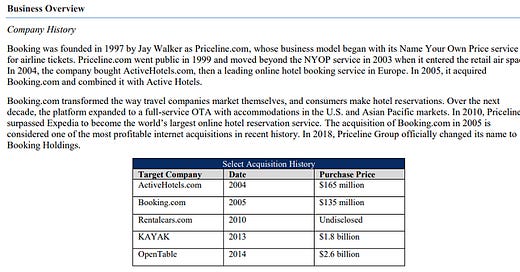

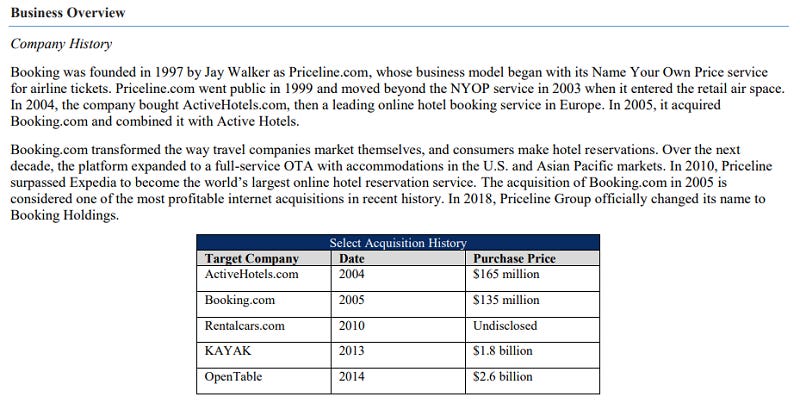

Company history

Business summary

Competitive landscape & business model

Industry overview

Investment Thesis

Clearly explain why this stock is mispriced or has upside.

Break it into 2-3 key reasons (e.g., margin expansion, industry growth, overlooked catalysts).

Support each point with data and logic.

Compare against peers or historical performance.

Every claim should have supporting evidence.

Best practices

Focus on the most impactful drivers of value.

Back up claims with data and industry insights.

Clearly explain why the market is mispricing the opportunity.

Avoid

Listing too many reasons without depth.

Making claims without providing supporting evidence.

Ignoring counterarguments or risks.

Example

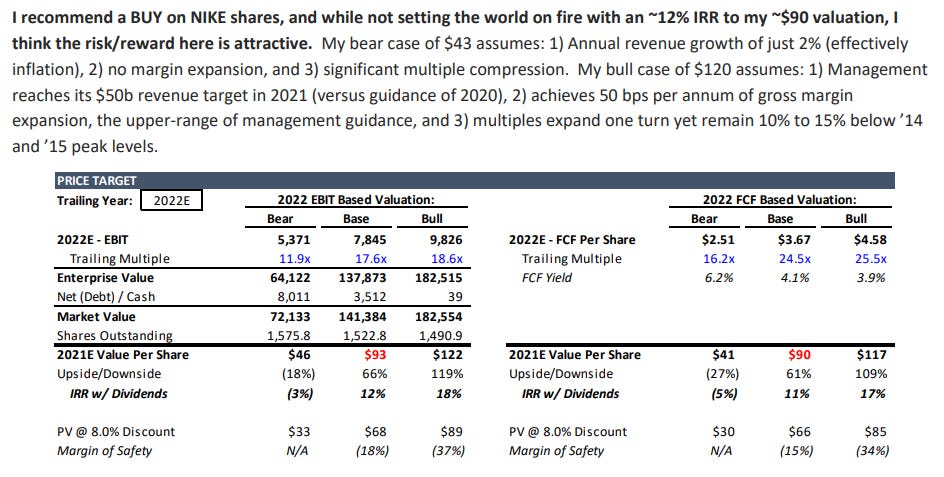

Valuation

Demonstrate that the stock is undervalued with clear valuation metrics.

Compare against historical multiples and industry peers.

Use EV/EBITDA, P/E, or other relevant metrics.

Show bear, base, and bull case scenarios.

Best practices

Use valuation multiples that are relevant to the business model.

Compare against industry benchmarks.

Include sensitivity analysis (e.g., bear/base/bull cases).

Avoid

Using valuation without explanation.

Making aggressive assumptions without justification.

Ignoring downside risks.

Example

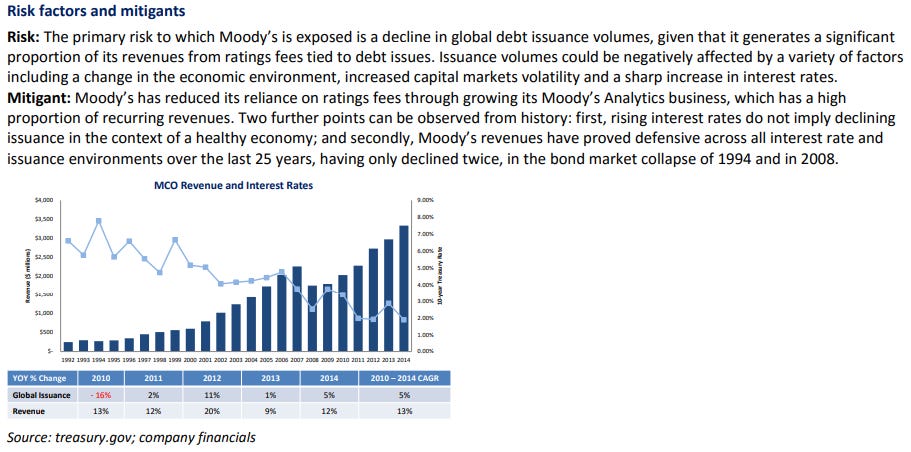

Risks

Address key risks and how they can be mitigated.

Identify 2-3 major risks.

Explain their potential impact.

Describe how the company can mitigate them.

Best practices

Prioritize the most material risks.

Provide context on how management is addressing these risks.

Show a balanced perspective—acknowledge risks but explain why they are manageable.

Avoid

Ignoring risks completely.

Listing too many risks without explaining impact.

Failing to provide mitigation strategies.

Example

EXTRA

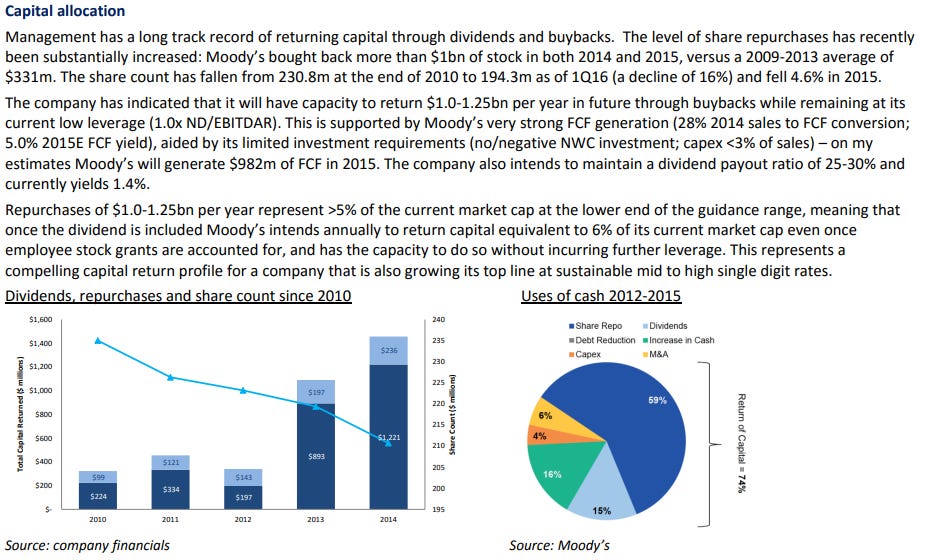

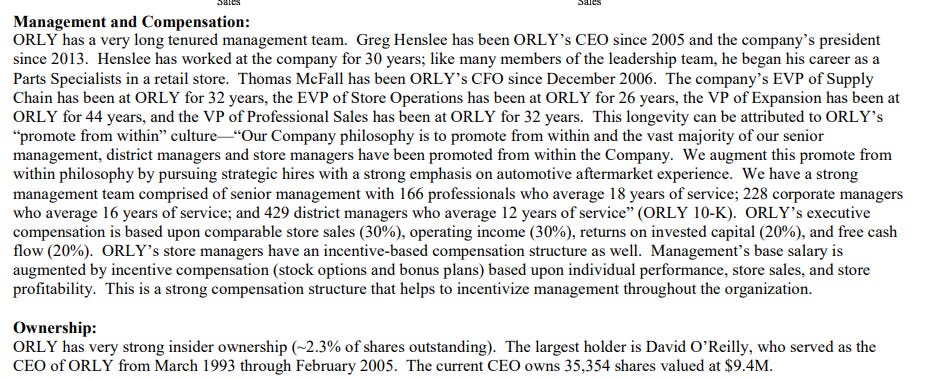

Management, Compensation, and Capital Allocation

Assess the quality of the management team and how they allocate capital. You can add this section before or after the “Valuation” section.

Evaluate the track record of the leadership team.

Review compensation structures—are they aligned with shareholder value?

Analyze capital allocation decisions (e.g., dividends, share buybacks, acquisitions).

Compare ROIC against competitors.

Best Practices

Look at management’s history of execution and decision-making.

Assess whether compensation incentives encourage long-term value creation.

Highlight whether capital allocation decisions are efficient and sustainable.

Avoid

Ignoring management’s role in value creation.

Assuming all buybacks or acquisitions are positive without deeper analysis.

Overlooking dilution risks from excessive stock-based compensation.

Example

Capital allocation

Management compensation

Ownership

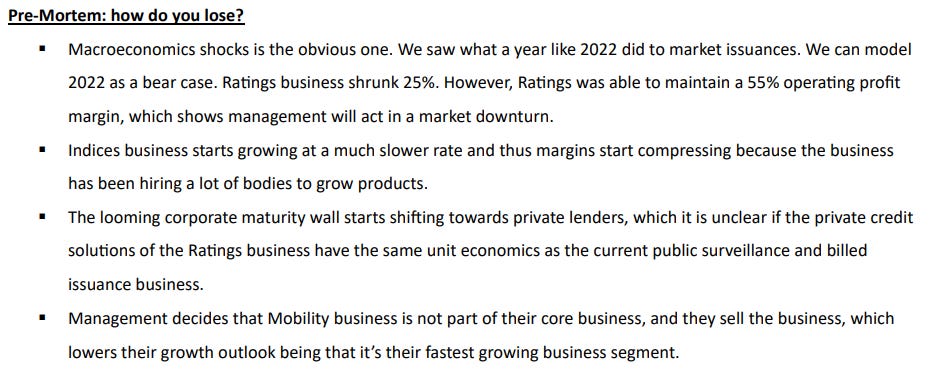

Pre-Mortem Analysis

Identify potential reasons why the thesis might fail before they happen.

What could go wrong that would invalidate the investment thesis?

How might management fail to execute key strategies?

Are there external risks (regulatory, macroeconomic, industry shifts) that could derail expectations?

What early warning signs should investors monitor?

If you wanna learn more about the pre-mortem analysis, buy my ebook on Behavioral Investing.

Example

Catalysts

Identify key events that will drive the stock price higher.

Short-term and medium-term catalysts.

Be specific. What earnings reports, regulatory changes, or market shifts could cause the re-rating?

Best practices

Identify events with a clear impact on valuation.

Explain how each catalyst will drive price appreciation.

Prioritize near-term catalysts that the market is ignoring.

Avoid

Listing generic catalysts that apply to any company.

Failing to explain why a catalyst matters.

Ignoring potential risks to catalysts materializing.

Summary

It is always important to learn how to improve when writing our conclusions when analyzing companies to invest in.

Studying and analyzing how professionals write their investment theses is an excellent way to apply it to our investment theses.

To finish:

Here is the link to the investment theses I mentioned in the post:

1. S&P Global thesis. Richard Lalane, CFA. April 25, 2024. Link: https://business.columbia.edu/sites/default/files-efs/imce-uploads/S%26P%20Global_Richard%20Lalane.pdf

Booking Holdings thesis. Jeffrey Johnson. May 7, 2019. Link: https://business.columbia.edu/sites/default/files-efs/imce-uploads/BKNG.pdf

Otis Worldwide Corporation thesis. Stephanie Moroney. May 5, 2020. Link: https://business.columbia.edu/sites/default/files-efs/imce-uploads/OTIS.pdf

Moody's thesis. Christopher White. May 4, 2016. Link: https://business.columbia.edu/sites/default/files-efs/imce-uploads/MCO%20-%20Christopher%20White.pdf

Nike thesis. Nielsen Fields, CFA. April 25, 2017. Link: https://business.columbia.edu/sites/default/files-efs/imce-uploads/NKE_Nielsen%20Fields.pdf

O'Reilly Automotive. Derek Johnson. April 30, 2016. Link: https://business.columbia.edu/sites/default/files-efs/imce-uploads/ORLY%20-%20Derek%20Johnson.pdf

Found this post helpful?

Share the love! Like or share it with your friends.

Got a burning question or a topic you're curious about? I'd love to hear from you! Please drop a comment 💬 below or shoot me an email 📧 at worldlyinvest@gmail.com

DISCLAIMER: The content of this newsletter is distributed for informational and educational purposes only and should not be construed as investment advice or a recommendation to sell or buy any security or other type of investment.

Do your due diligence and seek professional advice if necessary.

If you wanna study the theses, you can find them here: https://business.columbia.edu/heilbrunn/curriculum-courses/5x5x5-russo-student-investment-fund

Thank you for the value!