Daily Journal Corp (DJCO): SOTP Says +30% Upside, Market Says Meh

Daily Journal Corporation presents a compelling deep value opportunity, currently trading at a ~19% discount to intrinsic value, with a conservative target price of $440/share and up to 30% upside.

Executive Summary

Daily Journal Corporation (NASDAQ: DJCO) presents a compelling deep value opportunity, currently trading at a ~19% discount to intrinsic value, with a conservative target price of $440/share and up to 30% upside in the bull case. The market is mispricing its core software segment, Journal Technologies, which is beginning to show signs of margin expansion and sustained revenue growth, while also overlooking the embedded downside protection of its $343 million equity portfolio. This disconnect stems from limited investor communication, lack of analyst coverage, and a broader market pullback — the stock is down 35% YTD, driven largely by a market-wide sell-off triggered by trade war from the Trump administration.

Company overview

The company has two structurally distinct segments: a cash-generating but structurally declining legal publishing operation, and a high-margin, underpenetrated legal technology business serving public sector agencies. It has a strong-clean balance sheet with no long-term debt and a large portfolio of marketable securities. Let’s talk about his business segments:

Journal Technologies – a proprietary suite of configurable, browser-based case management software systems sold to government justice agencies. The product ecosystem includes eCourt, eDefender, eProsecutor, eProbation, eFile, and ePayIt. These platforms enable digital transformation in judicial workflows by offering electronic filing, payment, scheduling, and full case lifecycle management.

It generates revenue primarily through multi-faceted contracts with government agencies, which typically include software license and support fees, implementation consulting, third-party hosting services, and usage-based transaction fees. These contracts are often multi-year in nature and structured to support long-term relationships with public sector clients such as courts, prosecutors, and defenders. In addition to recurring license and support fees, the company also earns variable revenue through online public access portals—such as those used for e-filing or citation payments—where it collects a portion of the transaction processing fees.

This DJCO’s core growth engine, contributing over 70% of total revenues in recent years. Its customers—primarily courts, public defenders, prosecutors, and probation departments—engage through long-term contracts with recurring licensing and maintenance revenue. In the last 5y, it has a revenue CAGR of 10.3%; and in FY 2023 revenues jump 35% YoY by large implementations and international expansion (e.g., Australia).Traditional Publishing – a portfolio of adjudicated legal newspapers and online publications, including the Los Angeles Daily Journal, San Francisco Daily Journal, and Daily Commerce. These publications generate revenue through legal subscriptions, commercial advertising, and government-mandated public notice advertising.

Publishing represents DJCO’s legacy operations and remains relevant due to its adjudicated status for public notice advertising—particularly in California and Arizona. While structurally declining, the business has proven resilient and continues to generate consistent, albeit modest, free cash flow. In contrast to Journal Technologies, the publishing revenue CAGR in the last 5 years is just 3.4%. The growth was driven by pricing and not volume.

Industry Overview

The global legal technology market reached $26.7 billion in 2024 and is projected to grow at a CAGR of 10.2%, reaching $46.8 billion by 2030. This expansion reflects a fundamental transformation in how legal services are delivered—particularly in the public sector—through the deployment of software-driven workflows, cloud computing, and AI-powered analytics.

Legal tech spans a broad set of use cases, including:

Case management systems

E-discovery and document automation

Contract lifecycle management (CLM)

AI-driven legal research and predictive analytics

E-billing and remote legal services

Challenges: Government procurement cycles are long and complex, with revenue often deferred until full implementation. Integration with outdated legacy systems remains a technical hurdle, despite the platform’s configurability. Additionally, the sensitive nature of legal data demands ongoing investment in cybersecurity and regulatory compliance, particularly under frameworks like GDPR and CCPA. Finally, project timelines are vulnerable to client-side delays, which can impact both revenue recognition and cash flow consistency.

Growth drivers: The industry is experiencing strong secular growth driven by the digital transformation of legal workflows, widespread cloud adoption, and the rise of hybrid work models. Courts and public agencies increasingly require configurable, remote-accessible systems like Journal Technologies’ eSeries platform. Broader trends in AI, automation, and managed legal services further support demand for integrated case management solutions. As legal institutions modernize and outsource tech infrastructure, providers with domain expertise and long-term support capabilities are well positioned to scale.

Moats

We can say the Journal Technologies (JT) has high switching costs: Case management systems like eCourt and eProsecutor are deeply embedded in court operations, handling sensitive processes such as filings and compliance. Implementations are lengthy, highly customized, and require extensive user training—making vendor transitions costly, disruptive, and politically burdensome.

The platform’s configurability further deepens client lock-in by tailoring workflows to specific jurisdictions, rendering generic alternatives less viable. Combined with the complexity of public-sector procurement and Journal Technologies’ longstanding reputation across 42 U.S. states, these factors create strong institutional inertia. As a result, customers rarely switch providers, ensuring high retention and durable revenue streams.

Management & Capital Allocation

Insider ownership is low, less than 1%. In response, DJCO has introduced equity-based compensation to supplement its historically cash-focused plans. The CEO now participates in a stock-based incentive program, while the CFO continues under a legacy Management Incentive Plan (MIP) tied to pre-tax earnings. An anti-hedging policy further reinforces behavioral alignment by preventing hedging of company stock.

Capital Allocation

Capital allocation is conservative, disciplined, and historically shaped by the late Charlie Munger, who served as Chairman until 2023. The company does not pay dividends and has no formal buyback program, though it has repurchased 424,307 shares over time—primarily to offset dilution from executive incentive plans. Management has emphasized retained earnings reinvestment into:

Internal product development at Journal Technologies

Ongoing R&D for software enhancements

Strategic preservation of its equity investment portfolio

As of FY2024, DJCO held a marketable securities portfolio valued at ~US$249 million, accounting for nearly 49% of the company’s total current market cap.

This concentrated equity portfolio is a legacy of Charlie Munger, whose value investing principles shaped its construction.

The portfolio serves multiple strategic functions:

Self-financing operations and innovation at Journal Technologies

Mitigating liquidity risk during periods of delayed software revenue or court budget constraints

Investment Thesis

Why DJCO is Undervalued

DJCO is materially undervalued on a sum-of-the-parts basis. At its current stock price of ~$367, the stock trades at a 19% discount to intrinsic value based on conservative assumptions — and up to 30% upside in the bull case. The market is failing to properly value JT, which is showing signs of operating leverage and double-digit revenue growth, but still priced like a low-margin IT services business. Meanwhile, DJCO’s equity portfolio alone accounts for over 50% of the market cap, providing a hard floor on downside. With no long-term debt, high-quality assets, and real optionality in the core SaaS business, this is a classic case of durable value hidden under bad optics.

Why This Opportunity Exists

DJCO doesn’t fit into any clean institutional bucket. It’s part sleepy publisher, part legacy holding company, and part govtech software firm — but without an earnings call, without analyst coverage, and without investor communication.

The current environment is doing it no favors — YTD, the S&P 500 is down 13.9% YTD, the Nasdaq down 19.2%, and the Russell 2000 down 18.8%, dragging DJCO along with broader risk-off sentiment. Just in 2025, DJCO is down 35%, trading near his 52-w lows.

Add in escalating trade tensions and tariff rhetoric from the Trump administration, which has spooked markets, , and you get a perfect storm of investor apathy.

Valuation

I’m gonna do a quick SOTP valuation.

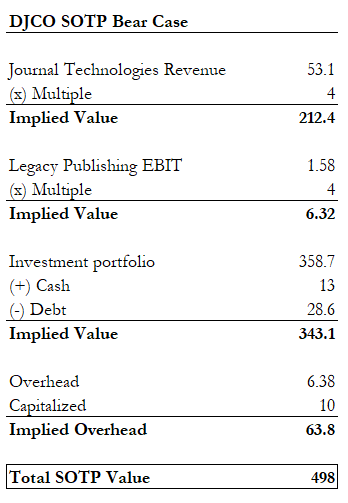

Bear case

In the bear case, I assume that core operations underperform expectations, which is reflected in a compressed valuation multiple for JT. The segment currently operates at a single-digit operating margin (~4.7%), well below the ~15% margin profile of a peer like TYL. The company continues to incur heavy costs for implementation and R&D, and it has struggled to achieve scalable operating leverage.

Most importantly, JT serves government clients, which are notoriously slow to pay and adopt new systems. This introduces working capital strain and delays in revenue realization, limiting short-term upside flexibility. A 4× EV/Revenue multiple is consistent with how the market prices low-margin IT services or low-growth SaaS businesses with execution risk and margin pressure.

For the publishing segment, this is clearly a legacy business in decline. Revenue continues to fall, print circulation is shrinking, and there is no evidence of successful monetization through digital channels. Reinvestment? No way, José. A 4× EBIT multiple reflects minimal terminal value, assuming the segment can continue to produce modest, stable cash flows without requiring new capital or reinvention.

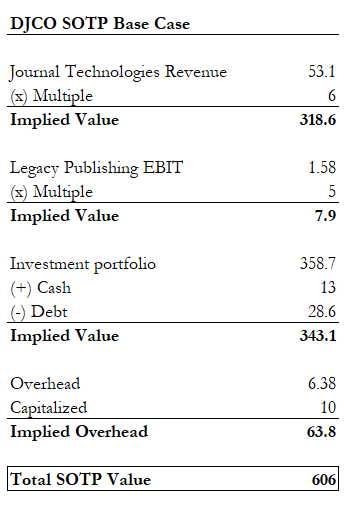

Base Case

In the base case, I assume JT does what it's been doing: slowly growing, spending a lot, and eventually figuring it out. Margins are still stuck in single digits (~4.7%): the contracts are sticky, the tech is real, and governments move at glacial speed, which works both for and against them. I assign a 6× EV/Revenue multiple — a solid discount to TYL (which trades at 11.6×), because unlike TYL, these guys don’t really talk to investors and aren’t in a hurry to prove anything. But give them some margin expansion and implementation wins, and this looks better than it gets credit for.

Now, for the publishing segment — it’s still here. Revenue’s going down, circulation’s going down, and digital innovation? Let’s just say they’re not leading that charge. But there’s still money in legal notices, and they’ve trimmed the cost base to the bone. I give it a 5× EBIT multiple, which is what you give something that’s not dying fast enough to be worthless, but not growing enough to pretend otherwise. No illusions — this is a print cash machine on autopilot, and it just needs to not crash.

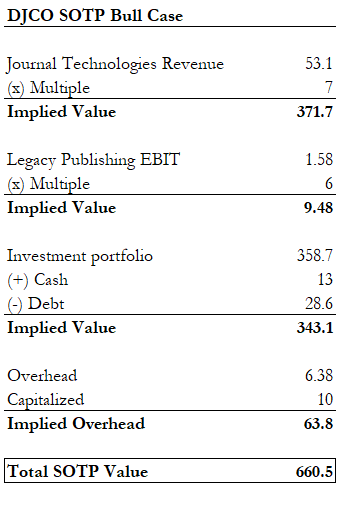

Bull case

In the bull case, JT finally gets its act together. The implementation bottlenecks start clearing, margin expansion kicks in, and we stop pretending that single-digit operating margins are a permanent feature of a software company. Maybe they land a few big contracts, maybe they execute a little faster, maybe the engineering team stops writing code that needs to be rewritten three months later. Whatever the reason, the business starts to look more like a scaled govtech SaaS player. I apply a 7× EV/Revenue multiple, which is still a ~40% discount to TYL — just enough optimism to recognize the product’s value, without pretending this is the next Salesforce for judges.

On the publishing side, I assume a slow decline that’s slower than we thought, which frankly wouldn’t be surprising. Public notice laws stay intact, no one figures out how to digitize them without upsetting 85 years of legal precedent, and the Daily Journal keeps doing what it does best: printing stuff the government requires. I give it a 6× EBIT multiple — not because I think it’s suddenly strategic, but because even dinosaurs can shuffle along longer than you expect. It’s still cash flow, and in the bull case, I’m happy to let it quietly cover overhead while JT shines.

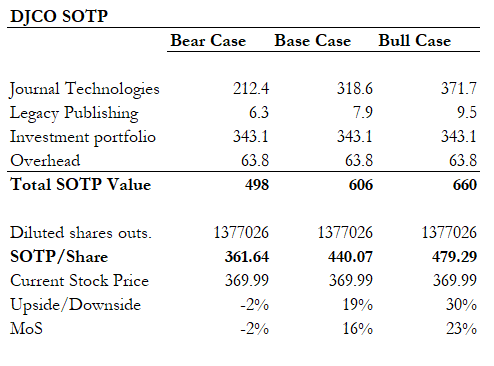

Ok, now let’s answer the most important question: How much does DJCO worth?

So: in the bear case, you might lose 2% (which isn’t bad for a downside). In the base case, you earn a solid 19%. And in the bull case, you get paid 30% for believing they can actually deliver on their tech roadmap.

Risks

JT fails to scale profitably: still operates at single-digit margins despite years of investment — and there’s no guarantee it ever achieves the scalable economics expected of a SaaS business. Heavy implementation costs, complex government clients, and long procurement cycles could keep margins stuck, limiting upside. Our base and bull cases assume modest improvement, but if execution lags or contracts stall, the market may continue assigning a low multiple to this business.

Investment portfolio risk: Over 50% of DJCO’s intrinsic value comes from its investment portfolio, which naturally fluctuates with the market. A mistimed investment or market downturn could drag the stock — even if operations perform. Remember: Charlie Munger is no longer with us.

Federal budget cuts to the US legal system: JT relies on spending from court systems, many of which are indirectly funded by federal and state budgets. If the Trump administration imposes budget cuts to the justice system or disrupts funding to modernize legal infrastructure, this could lead to slower procurement, cancelled implementations, or reduced demand for enterprise legal software. Growth slows, and margins stay compressed.

Catalysts

Operating leverage finally showing up at JT: In the most recent quarter (Q1 FY2025), Journal Technologies reported 12% revenue growth year-over-year, with standout performance in e-filing (+55%) and licensing revenue. Even more notable: pre-tax income jumped 36%, suggesting that margins are beginning to expand — finally. If this trend continues, it could mark a turning point in investor perception, validating the core of the bull case and justifying a higher EV/Revenue multiple.

Insider buying after extended inactivity: There’s been no insider activity for DJCO, which makes any future insider buying a potential inflection point. Given the company’s minimalist approach to investor communications (read: silence), insider purchases serve as one of the clearest signals of management confidence.