Big Technologies (BIG.L): A High-Quality Microcap at a Bargain Price

Why there's an opportunity in BIG

Investment Thesis

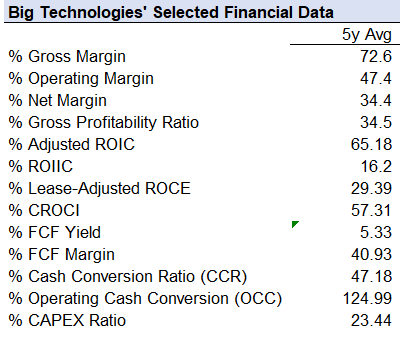

Big Technologies PLC (BIG.L) is a high-quality microcap with a strong competitive moat, operating in a high-barrier-to-entry industry with recurring revenue streams and exceptional capital efficiency. The company's leading position in the electronic monitoring market, combined with long-term government contracts and high customer retention, makes it a compelling investment at current valuation levels.

Despite recent headwinds, including the termination of the Colombian contract, the business fundamentals remain intact. Revenue is expected to decline in FY24 due to this contract loss, with an estimated £50.3 million vs. £55.2 million in 2023. However, this presents a short-term buying opportunity, as the company has zero debt, a strong cash balance, and a scalable business model.

Why BIG is Undervalued

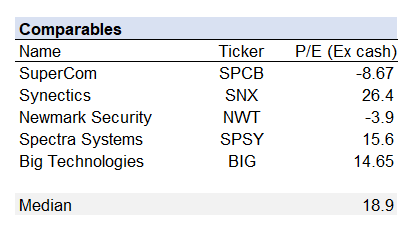

The stock appears expensive on a traditional P/E basis but trades at 14.65x P/E ex-cash, well below the peer median of 18.9x.

The company has been growing FCF at a 3y CAGR of ~32%, demonstrating its strong cash-generating ability.

The CEO owns 25.3% of the company.

Why This Opportunity Exists

The Colombian contract loss has created a temporary price dislocation, allowing investors to buy a high-quality business at a discount.

Mr. Market underestimate the sticky nature of Big Technologies' government contracts, which have high switching costs and renewal rates.

Company Overview

The company’s business model is built around long-term, subscription-based contracts, ensuring a highly recurring revenue stream.

BIG is the creator of the famous Buddi Smart Tag, an ankle monitor that integrates seamlessly with the company’s proprietary Buddi Eagle software. This end-to-end monitoring solution enables law enforcement agencies to track offenders in real time, enforce compliance, and reduce the burden on traditional incarceration systems. Other products are:

Buddi AlcoTag: a wearable alcohol detection device

Buddi Wristband: offers advanced capabilities such as fall detection and GPS tracking, serving the burgeoning remote care market.

The company operates across three major regions: Europe (£7.55 million), Asia-Pacific (£32.29 million), and the Americas (£15.38 million). APAC remains BIG’s largest market, however, Europe is the strongest-performing region, growing 9% YoY, driven by new and expanded government contracts. The criminal justice sector gives the 99% of revenue; while the rest comes from the remote care products.

Let’s talk about the contracts. They have long-term contracts with government agencies, ranging from 3 to 12 years. Switching costs for government clients are exceptionally high, as transitioning to a new provider requires retraining staff, reconfiguring compliance procedures, and ensuring seamless integration of new systems. As a result, the company enjoys exceptionally high customer retention rates, and they recently extended a U.S. contract through 2030.

I think BIG has two types of moats:

High switching costs: Government agencies do not treat electronic monitoring solutions as simple procurement decisions. These systems are deeply embedded into law enforcement workflows, with officers trained on specific platforms and compliance procedures built around existing solutions. Transitioning to a new provider requires retraining staff, updating procedures, and ensuring seamless data continuity—all of which create friction against switching. This means that once Big Technologies secures a contract, the likelihood of retention is exceptionally high. Additionally, many of its contracts are multi-year agreements (up to 12 years in some cases), further reinforcing the stickiness of its customer base.

High barriers to entry: Governments do not award electronic monitoring contracts lightly. Vendors must demonstrate years of operational success, pass rigorous security audits, and comply with strict data protection laws. Even if a new entrant were to develop a comparable product, navigating the regulatory approval process, building institutional trust, and securing contracts would take years—providing Big Technologies with a time advantage that shields it from competitive threats.

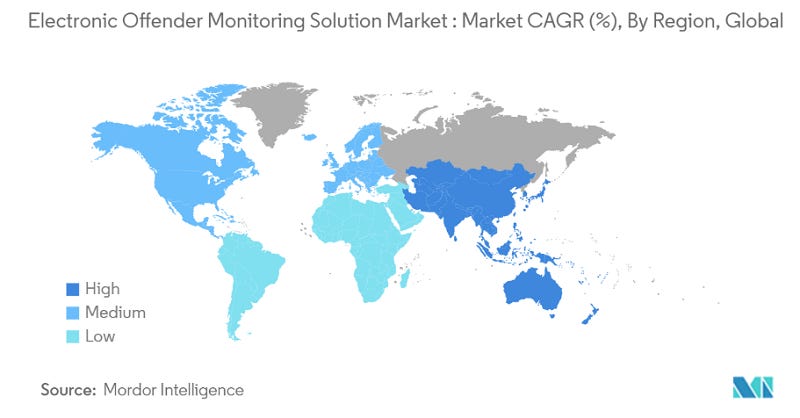

Industry

The electronic monitoring industry is experiencing sustained growth, driven by shifting criminal justice policies, technological advancements, and demographic changes that support long-term demand. According to Mordor Intelligence, the global electronic offender monitoring solutions market is projected to reach $3.19 billion by 2030, growing at a CAGR of 7.91%.1 Governments worldwide are increasingly turning to electronic monitoring as an alternative to incarceration2, recognizing it as a cost-effective and scalable solution for managing offenders under parole, probation, or house arrest. At the same time, the remote healthcare sector is seeing growing adoption of monitoring devices for elderly care, providing another avenue for industry expansion.

Electronic monitoring has proven to be largely recession-resistant, particularly in the criminal justice sector. Unlike consumer-driven industries, the demand for monitoring services remains stable regardless of economic cycles, as governments must continue supervising offenders and ensuring compliance with sentencing mandates. In fact, during periods of budget constraints, electronic monitoring can become even more attractive as a lower-cost alternative to incarceration.

Most companies operate on a recurring revenue model, leasing monitoring devices under long-term contracts, which reduces upfront costs for customers while ensuring a steady stream of cash flow. While initial investments in R&D are necessary to maintain technological leadership, ongoing CAPEX remain relatively low, allowing for scalability without excessive reinvestment needs.

Valuation

Why do I think BIG is cheap? Let’s see:

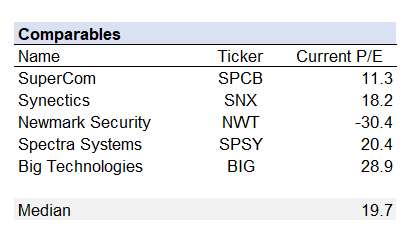

If you take a look at the current P/E, you’ll notice that BIG appears to be overvalued, right?

Wrong!

What we need to do is adjust the P/E by excluding cash.

Now the story is completely different: BIG is trading @14.65x P/E ex-cash, below the peer median of 18.9x.

Is this cheap? Hell yeah!

Now, let’s take a look at a DCF analysis:

BIG has been growing its FCF at an average rate of 24.29% over the last 3y. I think this growth rate will normalize as the company matures. I always like to be conservative rather than too optimistic or too bearish, so let’s say that BIG will grow its FCF by 10% over the next 5y.

This is a high-quality, growing microcap company, and certainly, it has some risk. That’s why I use a 12% discount rate.

How much is BIG worth?

DCF says it's worth £1.49/share. With the current stock price of £1.15 (as of 02/04/2025), that's a 29.6% upside.

Remember: this is my conservative scenario, so I think it could be worth more than that.

Again: the company is cheap.

What will be my maximum buy price for the company?

Between £1.74 and £2.01 per share.

Bottom line: You're getting an FCF machine for less than its true value.

Risks

Customer Concentration Risk: The 10 largest customers account for 75% of total revenue, increasing dependence on a limited client base.

Competition: Larger multinational security firms are expanding their presence in electronic monitoring, intensifying competitive pressure.

Regulatory & Compliance Risk: Non-compliance with privacy laws, cybersecurity requirements, or human rights standards could lead to fines, contract terminations, or reputational damage.

Contract Risks: Failure to secure new contracts or losing existing ones could negatively impact revenue and growth.

Catalysts

Expansion into the U.S. Market: Big Technologies recently secured a key contract extension with a major U.S. customer through 2030. If the company continues to penetrate the U.S. criminal justice system, it could unlock multi-year recurring revenue growth driven by long-term contracts.

International Growth Opportunities: Beyond the U.S., many European and APAC countries are increasing their adoption of electronic monitoring as an alternative to incarceration. With its established relationships and strong track record, BIG can win new government contracts in these underpenetrated markets.

Product Innovation: The launch of Buddi AlcoTag expands the company’s market beyond traditional offender tracking. With governments integrating alcohol and drug monitoring into probation and addiction treatment programs, this product could become a meaningful revenue contributor over time. Also, entering the remote care market.

M&A: BIG operates in an industry with few players, making it a potential acquisition target for larger firms looking to enter the space. Given the complexity of developing competitive technology from scratch, a major industry player may find it easier to acquire BIG rather than build a rival platform.

Things I Don’t Like

Aggressive Use of Adjusted Metrics: Big Technologies relies heavily on adjusted profit metrics, particularly Adjusted EBITDA and Adjusted Operating Profit, which exclude SBC expenses and other “adjusting items”. In 2023, the company reported an adjusted operating profit of £28.2 million, which was 67.9% higher than its statutory operating profit of £16.8 million. The largest adjustment was £10.9 million in SBC, which, while a non-cash expense, still represents real dilution to shareholders.

High SBC: In FY23, SBC expense was £10.97 million, accounting for approximately 19.9% of total revenue (£55.2 million). This is a significant proportion, particularly for a capital-light business model.

FCF vs. Earnings Discrepancies: The company maintains strong FCF generation, but it has reported a decline in statutory profit, even as cash flow remains robust. While this is partly due to high depreciation and amortization (D&A) charges, it is important to monitor whether cash flow continues to support reported profitability over time or if earnings quality deteriorates due to excessive adjustments.

Management's Optimism: Management's frequent emphasis on adjusted metrics over statutory results suggests a preference for presenting an overly optimistic financial narrative.

DISCLOSURE: No position

If you liked this high-quality microcap….

I launched two ebooks that will help you to understand how to invest in microcaps and quality companies.

Ebook + Bonus for just $10.99 each.

Got a burning question or a topic you're curious about? I'd love to hear from you! Please drop a comment 💬 below or shoot me an email 📧 at worldlyinvest@gmail.com

DISCLAIMER: The content of this newsletter is distributed for informational and educational purposes only and should not be construed as investment advice or a recommendation to sell or buy any security or other type of investment.

Do your due diligence and seek professional advice if necessary.

Mordor Intelligence. Electronic Offender Monitoring Solutions Market - Size, Share & Companies. 2025. Available at: https://www.mordorintelligence.com/industry-reports/global-electronic-offender-monitoring-solutions-market

Kaylor, L.E. (2022). Electronic Monitoring as an Alternative to Incarceration as Part of Criminal Justice Reform. In: Jeglic, E., Calkins, C. (eds) Handbook of Issues in Criminal Justice Reform in the United States. Springer, Cham. https://doi.org/10.1007/978-3-030-77565-0_35

Compelling company in a unique industry. Thanks for the article